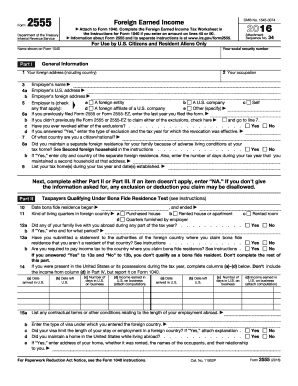

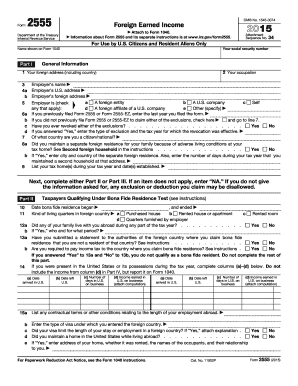

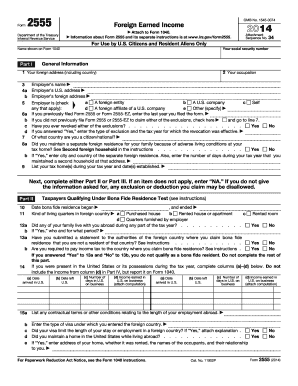

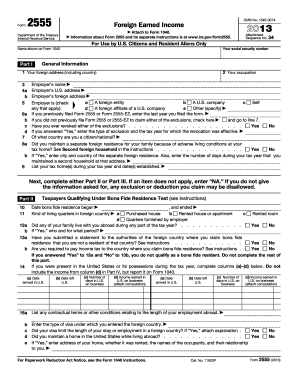

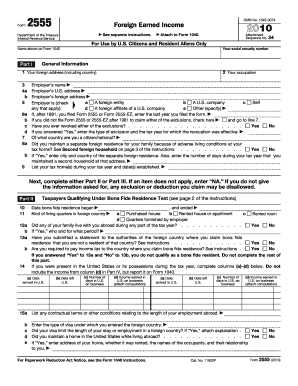

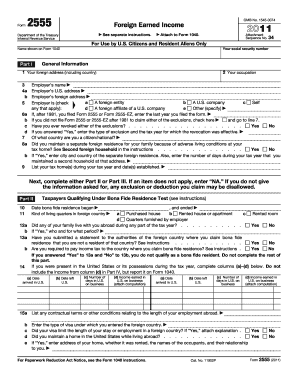

2555 Form

What is 2555 Form?

The 2555 Form, also known as the Foreign Earned Income form, is a document that is required by the Internal Revenue Service (IRS) for U.S. citizens or resident aliens who have earned income from foreign sources. It is used to determine if these individuals are eligible for the Foreign Earned Income Exclusion or other tax benefits.

What are the types of 2555 Form?

There are two types of 2555 Forms: 1. Form 2555: This form is used by individuals who qualify for the Foreign Earned Income Exclusion and want to exclude their foreign earned income from their U.S. taxable income. 2. Form 2555-EZ: This simplified form is available for individuals who meet certain criteria and want to claim the Foreign Earned Income Exclusion. It has fewer requirements and is easier to complete.

How to complete 2555 Form

Completing the 2555 Form may seem daunting, but with the right guidance, it can be done easily. Here are the steps to complete the 2555 Form:

By following these steps, you can successfully complete the 2555 Form and claim the benefits you're eligible for.