Equipment Lease Agreement With Option To Purchase

What is an equipment lease agreement with option to purchase?

An equipment lease agreement with an option to purchase is a contract that allows the lessee to rent equipment for a specified period and gives them the option to buy the equipment at the end of the lease term. This type of agreement is commonly used by businesses that need equipment but may not have the immediate funds to purchase it outright. It provides flexibility and the opportunity to test the equipment before making a final purchase decision.

What are the types of equipment lease agreement with option to purchase?

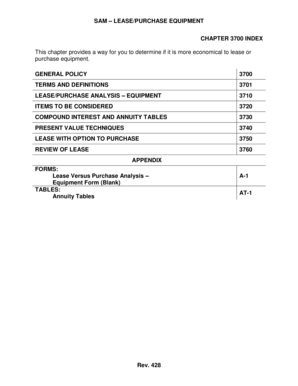

There are primarily two types of equipment lease agreements with an option to purchase: 1. Capital Lease Agreement: In this type of agreement, the lessee assumes most of the risks and rewards of owning the equipment. They are responsible for maintenance, insurance, and other costs associated with the equipment. At the end of the lease term, the lessee usually has the option to buy the equipment at fair market value. 2. Operating Lease Agreement: This type of agreement is more like a rental agreement. The lessor retains ownership of the equipment and is responsible for its maintenance and other costs. The lessee has the option to purchase the equipment at the end of the lease term at a predetermined price.

How to complete an equipment lease agreement with option to purchase

Completing an equipment lease agreement with an option to purchase is a simple process. Here is a step-by-step guide: 1. Gather the necessary information: Both the lessor and lessee should gather the relevant information, including names, contact details, equipment details, lease term, and purchase option details. 2. Use a trusted platform like pdfFiller: pdfFiller offers a user-friendly interface that allows you to easily create, edit, and share the equipment lease agreement online. Choose from a wide range of fillable templates or start from scratch. 3. Fill in the required details: Enter all the required details accurately in the fillable fields. Ensure that all the terms and conditions are clearly stated and agreed upon by both parties. 4. Review and proofread: Carefully review the completed agreement to avoid any errors or missing information. Proofread the entire document to ensure clarity and accuracy. 5. Sign and share: Once both parties are satisfied with the agreement, digitally sign the document. pdfFiller allows you to securely share the signed agreement with the other party through email or by generating a shareable link. By following these steps, you can easily complete an equipment lease agreement with an option to purchase and streamline your leasing process.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.