Financial Report Example

What is financial report example?

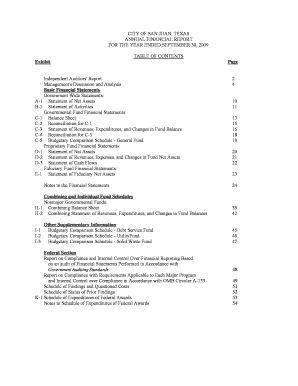

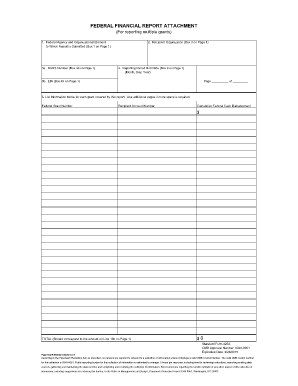

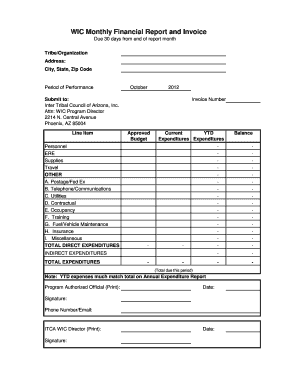

A financial report example is a document that summarizes the financial activities and performance of a business or organization. It includes information regarding revenue, expenses, assets, liabilities, and overall financial health.

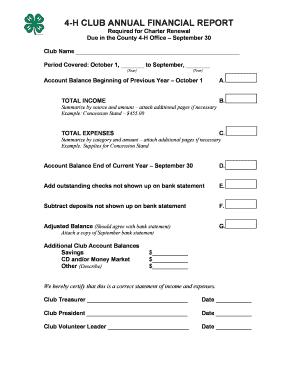

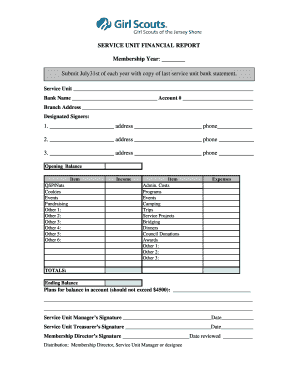

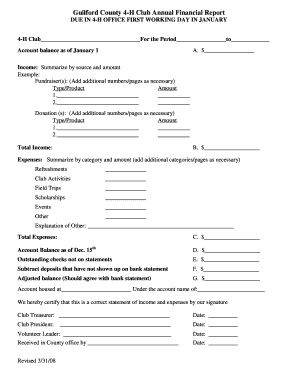

What are the types of financial report examples?

There are several types of financial reports that organizations commonly prepare. Some examples include: income statements, balance sheets, cash flow statements, and budget versus actual reports.

How to complete financial report example

Completing a financial report example can seem daunting, but with the right tools and knowledge, it can be a straightforward process. Here are some steps to help you complete a financial report example:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.