5 Types Of Financial Statements

What is 5 types of financial statements?

Financial statements are important documents that provide information about the financial health and performance of a business. There are five main types of financial statements:

What are the types of 5 types of financial statements?

The five types of financial statements are:

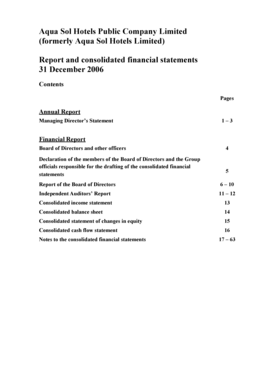

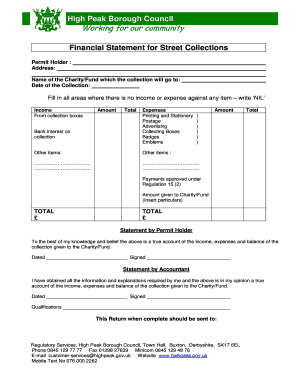

Income Statement: This statement shows the revenue, expenses, and profit or loss of a business over a specific period of time.

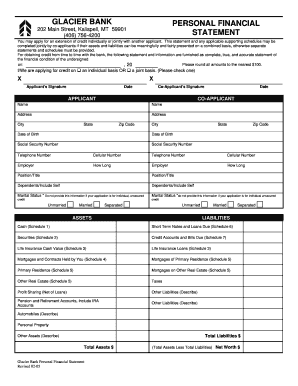

Balance Sheet: It presents the assets, liabilities, and equity of a company at a given point in time.

Cash Flow Statement: This statement tracks the cash inflows and outflows of a business during a certain period.

Statement of Changes in Equity: It outlines the changes in equity during a specific period, including share capital, retained earnings, and other comprehensive income.

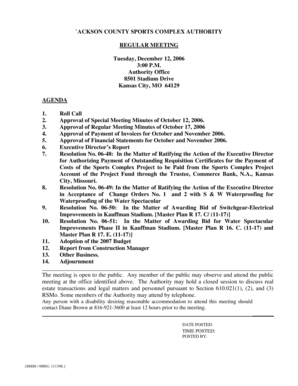

Notes to Financial Statements: These are additional explanations and disclosures that accompany the other financial statements and provide more details about the financial position of a company.

How to complete 5 types of financial statements

Completing financial statements can seem daunting, but with the right approach, it can be done effectively. Here are some steps to help you complete the five types of financial statements:

01

Gather all the necessary financial data, including revenue, expenses, assets, liabilities, and equity.

02

Organize the data and prepare it for input into the respective financial statements.

03

Use accounting software or templates to input the data and generate the financial statements.

04

Review the statements for accuracy and ensure all necessary information is included.

05

Analyze the financial statements to gain insights into the financial health and performance of the business.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 4 types of financial statements?

4 Types of Financial Statements That Every Business Needs Balance Sheet. Also known as a statement of financial position, or a statement of net worth, the balance sheet is one of the four important financial statements every business needs. Income Statement. Cash Flow Statement. Statement of Owner's Equity.

What are the five 5 Composition of financial statements?

Five elements of the financial statement include the balance sheet, income statement, statement of cash flow, statement of changes in equity, and the notes to the financial statements.

What are the 5 components of financial statements?

The 5 types of financial statements you need to know Income statement. Arguably the most important. Cash flow statement. Balance sheet. Note to Financial Statements. Statement of change in equity.

What are the 5 types of financial statements?

The 5 types of financial statements you need to know Income statement. Arguably the most important. Cash flow statement. Balance sheet. Note to Financial Statements. Statement of change in equity.

What are the major types of financial statements?

The three main types financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, its revenues and costs, as well as its cash flows from operating, investing, and financing activities.

What are the 6 basic financial statements?

There are four main financial statements. They are: (1) balance sheets. (2) income statements. (3) cash flow statements. and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time.

Related templates