What is financial report pdf?

A financial report PDF is a document that provides a summary of an individual or organization's financial activities and performance. It includes information such as balance sheets, income statements, cash flow statements, and other financial indicators. This report is often used by stakeholders, shareholders, and investors to assess the financial health and stability of an entity.

What are the types of financial report PDF?

Financial report PDFs can come in various types tailored to different purposes. Some common types include:

Balance Sheet: Presents a snapshot of a company's financial position at a specific point in time, showing its assets, liabilities, and equity.

Income Statement: Shows a company's revenues, expenses, and profits or losses over a specific period.

Cash Flow Statement: Provides an overview of a company's cash inflows and outflows, reflecting its ability to generate and manage cash.

Statement of Shareholders' Equity: Reports the changes in a company's equity over a period, including stock issuances, dividends, and retained earnings.

Statement of Comprehensive Income: Expands on the income statement by including other comprehensive income items, such as unrealized gains or losses on investments.

Notes to Financial Statements: Discloses additional information and explanations related to the financial statements to provide further context and transparency.

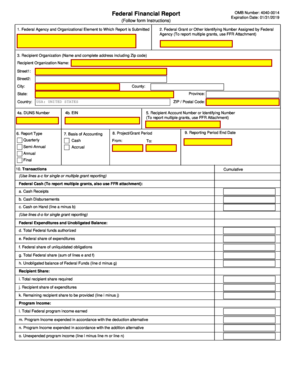

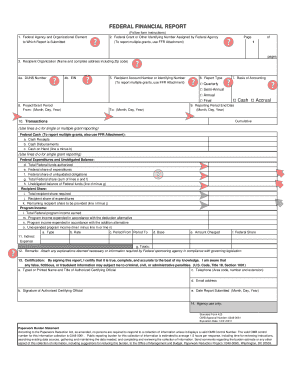

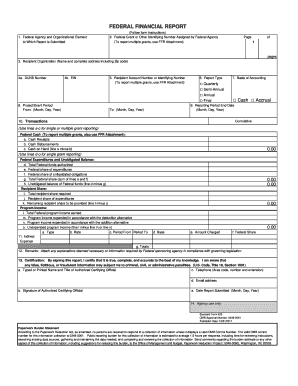

How to complete financial report PDF

Completing a financial report PDF can be done with the help of software like pdfFiller. Here are the steps to follow:

01

Choose a financial report template: pdfFiller offers a wide range of fillable financial report templates to choose from. Select the one that best suits your needs.

02

Input the required financial data: Fill in the necessary information, such as income, expenses, assets, liabilities, and equity. Ensure accuracy and completeness.

03

Review and verify the report: Double-check all the entered data for any errors or inconsistencies. Make sure all calculations are accurate.

04

Save and share the completed report: Once you are satisfied with the report, save it as a PDF file and share it with the intended recipients.

05

Consider consulting professionals: If you are unsure about any aspect of completing a financial report, it may be beneficial to seek guidance from financial experts or accountants.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their financial reports done efficiently.