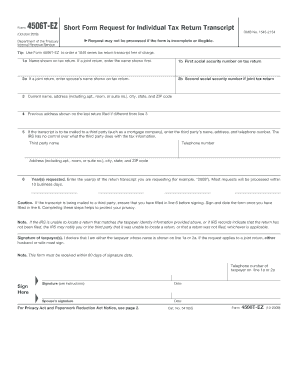

4506T-EZ Form

What is 4506T-EZ Form?

The 4506T-EZ Form is a document used by individuals or organizations to request their tax return transcripts from the Internal Revenue Service (IRS). It is commonly used for mortgage applications, loan modifications, and verification of income. The form allows taxpayers to authorize the release of their tax information to a third party, such as a lending institution.

What are the types of 4506T-EZ Form?

There is only one type of 4506T-EZ Form which is specifically designed for individuals and sole proprietors to request their tax return transcripts.

How to complete 4506T-EZ Form

Completing the 4506T-EZ Form is a straightforward process. Here are the steps to follow:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.