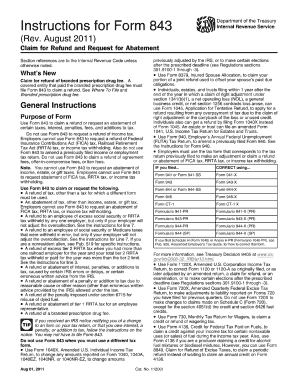

What is Instructions 843?

Instructions 843 is a set of guidelines or procedures that individuals or organizations need to follow in order to complete a specific task or achieve a desired outcome. These instructions provide step-by-step guidance and information on how to navigate through a particular process.

What are the types of Instructions 843?

There are several types of Instructions 843, each catering to different needs and objectives. Some common types include: 1. Basic Instructions: These instructions cover the fundamental steps required to complete a task. 2. Advanced Instructions: These instructions go beyond the basics and provide more detailed guidance for complex tasks. 3. Troubleshooting Instructions: These instructions help users identify and resolve common issues or problems that may arise during the task. 4. Safety Instructions: These instructions focus on ensuring the safety of individuals while carrying out a task. 5. Installation Instructions: These instructions guide users through the process of setting up and installing a particular product or system. It is important to choose the right type of Instructions 843 based on the specific requirements of the task at hand.

How to complete Instructions 843

Completing Instructions 843 requires a systematic approach and attention to detail. Here are the steps to follow:

pdfFiller is a powerful online platform that empowers users to create, edit, and share documents easily and efficiently. With unlimited fillable templates and robust editing tools, pdfFiller is the ultimate PDF editor for getting your documents done. Whether you're a student, professional, or business owner, pdfFiller provides all the necessary features to streamline your document management process. Start using pdfFiller today and experience the convenience of digital document editing and collaboration.