What is Personal Finance Proposal Template?

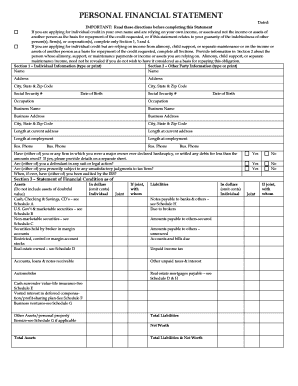

A Personal Finance Proposal Template is a document that outlines a proposed plan for managing personal finances. It provides a structure and guidelines for individuals to effectively track their income, expenses, savings, and investments. With a Personal Finance Proposal Template, users can create a comprehensive financial plan tailored to their specific needs and goals.

What are the types of Personal Finance Proposal Template?

There are various types of Personal Finance Proposal Templates available, each designed to address different aspects of personal finance. Here are some common types:

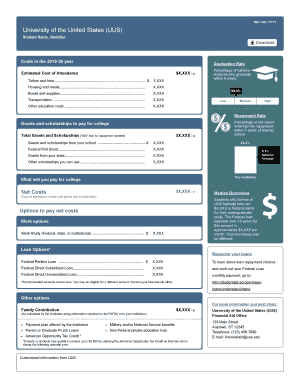

Budget Proposal Template: Helps users in creating and managing a budget to allocate income and expenses effectively.

Investment Proposal Template: Provides a framework for planning and evaluating various investment options.

Retirement Proposal Template: Assists users in defining retirement goals and creating a financial strategy to achieve them.

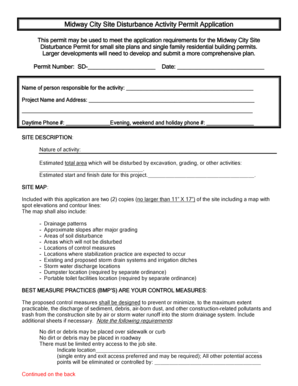

Loan Proposal Template: Helps individuals in assessing borrowing needs, calculating repayment plans, and applying for loans.

Savings Proposal Template: Guides users in setting savings goals and tracking progress towards achieving them.

How to complete Personal Finance Proposal Template

Completing a Personal Finance Proposal Template is a straightforward process. Here are the steps involved:

01

Start by gathering all your financial information, including income statements, expense receipts, bank statements, investment details, and any other relevant documents.

02

Identify your financial goals and objectives, such as saving for a specific item, paying off debts, or planning for retirement.

03

Review the different sections of the Personal Finance Proposal Template and fill in the necessary information, ensuring accuracy and completeness.

04

Utilize the editing tools offered by pdfFiller to customize the template as per your requirements, making it more personalized and visually appealing.

05

Once you have completed the template, review it carefully to ensure all the details are accurate and aligned with your financial goals.

06

Save the document in a secure location, either on your computer or in the cloud, so you can easily access and update it as needed.

07

Share the template with trusted advisors or family members if you seek their input and assistance in refining your financial plan.

08

Regularly update the Personal Finance Proposal Template to reflect any changes in your financial situation or goals.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.