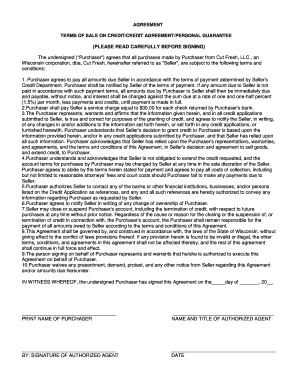

Personal Guarantee Letter Sample

What is personal guarantee letter sample?

A personal guarantee letter sample is a document that outlines the terms and conditions of a personal guarantee. It is commonly used in business transactions where one party agrees to be personally liable for the debts or obligations of another party.

What are the types of personal guarantee letter sample?

There are various types of personal guarantee letter samples available depending on the specific situation. Some common types include:

Limited Guarantee Letter: This type of letter limits the personal liability of the guarantor to a specific amount or timeframe.

Unlimited Guarantee Letter: In this type of letter, the guarantor assumes unlimited personal liability for the debts or obligations of another party.

Joint and Several Guarantee Letter: This type of letter allows multiple guarantors to be jointly and severally liable for the debts or obligations of another party.

Continuing Guarantee Letter: This type of letter remains in effect until it is revoked or terminated by the guarantor.

How to complete personal guarantee letter sample

Completing a personal guarantee letter sample involves the following steps:

01

Start by clearly identifying the parties involved, including the guarantor and the party whose debts or obligations are being guaranteed.

02

Specify the nature and extent of the guarantee, including any limitations or conditions.

03

Outline the terms of repayment or any other obligations of the guarantor.

04

Include any necessary legal language and provisions.

05

Review and edit the letter for accuracy and clarity.

06

Sign and date the letter to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out personal guarantee letter sample

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What personal guarantee means?

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

What are the three 3 types of guarantees?

Retrospective guarantee – It is a guarantee issued when the debt is already outstanding. Prospective guarantee – Given in regard to a future debt. Specific guarantee – Also known as a simple guarantee, it's a type that is used when dealing with a single transaction, and therefore a single debt.

What is personal guarantee example?

Corporate credit cards that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.

How do you write a guarantor letter to a company?

In this regard, I guarantee that the said person is having good moral character. I also ensure that he would not be doing any illegal activities inside or outside the company's premises. Also, _______________________ (mention other guarantee). You may consider this letter as an employment guarantee of the said person.

What is a personal guarantee letter?

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

What is a guaranty letter?

A letter of guarantee is an agreement by a bank (the guarantor) to pay a set amount of money to some person (the beneficiary) if a bank customer (the principal) defaults on a payment or an obligation to the beneficiary.