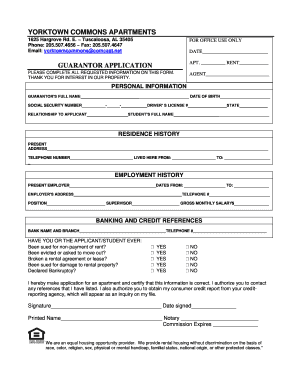

What is guarantor letter to employer?

A guarantor letter to employer is a formal document that serves as a guarantee for a person's financial obligations or responsibilities to their employer. It is typically used when an employee needs someone to vouch for their ability to fulfill a specific duty or commitment, such as repaying a loan, meeting financial targets, or completing a project.

What are the types of guarantor letter to employer?

There are several types of guarantor letters that can be written to an employer:

Financial Guarantor Letter: This type of guarantor letter provides a guarantee to the employer that the employee has the financial means to fulfill their obligations. It may include details about the employee's income, assets, and credit history.

Performance Guarantor Letter: This type of guarantor letter assures the employer that the employee will meet specific performance targets or complete a project within a designated timeframe. It may outline the employee's skills, experience, and past achievements.

Job Guarantee Letter: This type of guarantor letter is usually provided by a third party, such as a parent or close relative, who guarantees that the employee will perform their job responsibilities diligently and responsibly.

Character Guarantor Letter: This type of guarantor letter focuses on the employee's personal qualities and character traits that make them a reliable and trustworthy individual. It may include references from previous employers, colleagues, or community members.

How to complete guarantor letter to employer

Completing a guarantor letter to an employer requires attention to detail and adherence to proper formatting and content. Here are the steps to follow:

01

Begin by addressing the letter to the employer or hiring manager.

02

Provide your contact information, including your full name, address, phone number, and email.

03

State your relationship with the employee and the purpose of the guarantor letter.

04

Clearly outline your guarantee, specifying the obligations or responsibilities you are vouching for and the period of the guarantee.

05

Include any supporting documentation or references that strengthen your credibility as a guarantor.

06

Conclude the letter by expressing your confidence in the employee's abilities and your commitment to fulfill your obligations as a guarantor.

07

Sign the letter and provide your full name, designation, and contact information.

08

Make a copy of the letter for your records and submit the original to the employee or directly to the employer.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.