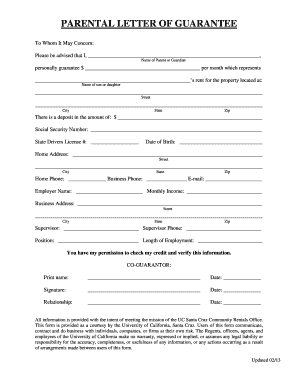

What is personal loan guarantee letter sample?

A personal loan guarantee letter sample is a document that outlines the terms and conditions of a personal loan, as well as the responsibilities of the guarantor. It serves as a legally binding agreement between the lender and the guarantor, ensuring that the loan will be repaid in case the borrower defaults. The letter includes details such as the loan amount, repayment terms, and the guarantor's obligations.

What are the types of personal loan guarantee letter sample?

There are several types of personal loan guarantee letter samples, each serving a specific purpose. Some common types include:

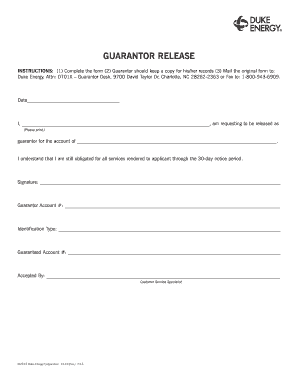

Unsecured personal loan guarantee letter sample: This type of letter is used when the loan is not backed by any collateral. The guarantor provides a personal guarantee to repay the loan if the borrower fails to do so.

Secured personal loan guarantee letter sample: This type of letter is used when the loan is secured by collateral, such as a house or a car. The guarantor pledges the collateral as security for the loan.

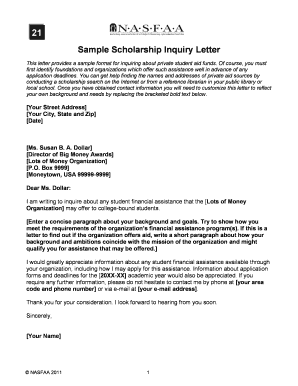

Student loan guarantee letter sample: This type of letter is specific to student loans and outlines the guarantor's responsibilities in case the student borrower is unable to repay the loan.

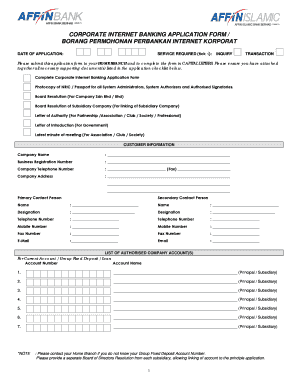

Business loan guarantee letter sample: This type of letter is used for business loans and specifies the guarantor's obligations if the business defaults on the loan.

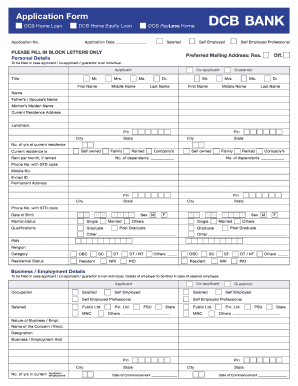

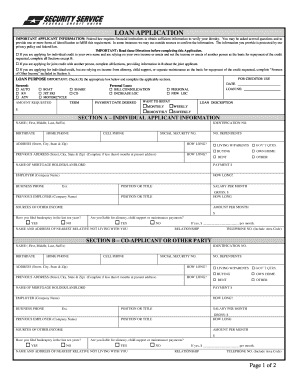

How to complete personal loan guarantee letter sample

Completing a personal loan guarantee letter sample is fairly straightforward. Here are the basic steps:

01

Begin by addressing the letter to the lender, using their proper name and contact information.

02

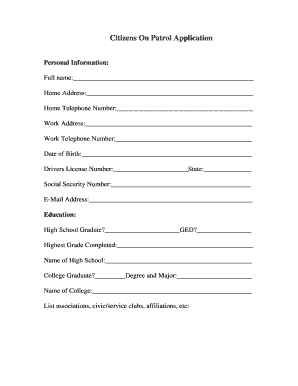

Introduce yourself as the guarantor and provide your full name and contact information.

03

State the purpose of the letter clearly, indicating that you are guaranteeing the repayment of a specific loan for a specific borrower.

04

Include all relevant loan details, such as the loan amount, interest rate, repayment term, and any specific conditions or requirements.

05

Clearly outline your obligations as the guarantor, including the consequences of non-payment or default by the borrower.

06

End the letter with a formal closing, your signature, and the date.

07

Make sure to keep a copy of the letter for your records.

pdfFiller empowers users to create, edit, and share personal loan guarantee letter samples online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to easily complete and customize your personal loan guarantee letter.