Personal Monthly Budget Spreadsheet - Page 2

What is Personal Monthly Budget Spreadsheet?

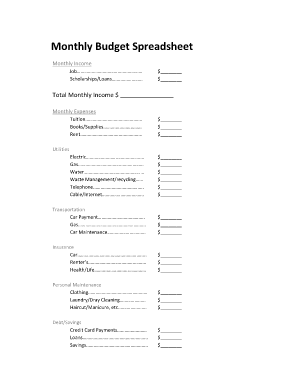

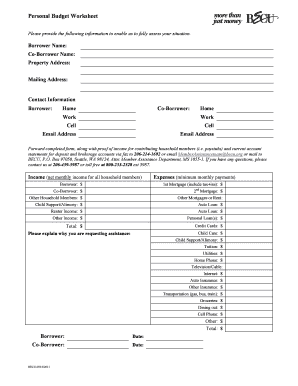

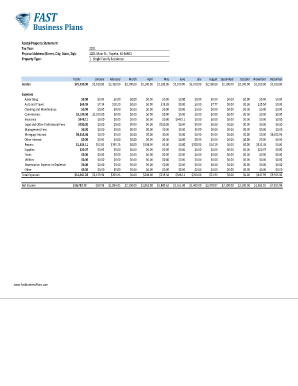

A Personal Monthly Budget Spreadsheet is a tool that allows individuals to track their income and expenses on a monthly basis. It provides a detailed overview of where money is coming from and where it is being spent. By using a budget spreadsheet, individuals can gain better control over their finances and make more informed financial decisions.

What are the types of Personal Monthly Budget Spreadsheet?

There are various types of Personal Monthly Budget Spreadsheets available, each catering to different needs and preferences. Some common types include:

How to complete Personal Monthly Budget Spreadsheet

Completing a Personal Monthly Budget Spreadsheet is a straightforward process. Here are the steps to follow:

By following these steps, you can effectively complete a Personal Monthly Budget Spreadsheet and improve your financial management skills. Remember, pdfFiller provides a comprehensive online platform that empowers users to create, edit, and share documents, including budget spreadsheets. With unlimited fillable templates and powerful editing tools, pdfFiller is the ideal PDF editor to help you efficiently complete your financial documents.