Get the free printable list of monthly expenses form

Show details

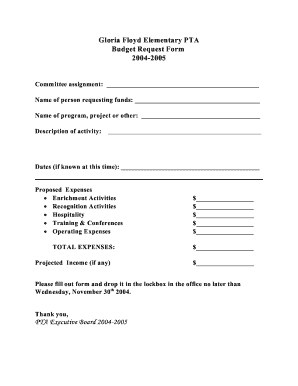

MONTHLY BUDGET WORKSHEET--LIST EXPENSES AND INCOME BELOW Fill in all expenses in average monthly amounts that apply EXPENSES AVG.MONTHLY LIST ALL INCOME SOURCES HOME/LIVING EXPENSES MORTGAGE/RENT FOOD ENTERTAINMENT TAXES INSURANCE OTHER HOMES EXP OTHER MISC. ENERGY/UTILITY COSTS OIL BILL GAS BILL WATER TELEPHONE CELL PHONE CABLE TV MISC. AUTOMOBILE EXPENSE LEASE/LOAN GAS REPAIRS/UPKEEP CREDIT CARDS LIST ALL BELOW MEDICAL INS COPAYS STUDENT LOANS TOTAL INCOME subtract Expenses from Inc TOTAL...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your printable list of monthly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your printable list of monthly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit printable list of monthly expenses online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit household monthly expense form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out printable list of monthly

01

To fill out a list of household expenses, start by gathering all relevant financial documents such as bills, receipts, and bank statements.

02

Next, categorize your expenses into different categories such as rent/mortgage, utilities, groceries, transportation, and entertainment.

03

Use a spreadsheet or a budgeting app to create a list of these categories and record each expense under the appropriate category.

04

Be thorough and include all recurring expenses as well as occasional or one-time expenses.

05

Additionally, it's helpful to set a budget for each category to ensure you are not overspending.

06

Regularly update and review your list to stay on top of your finances and identify any areas where you can reduce expenses or make adjustments.

Who needs a list of household expenses?

01

Individuals or families who want to track their spending and manage their finances effectively.

02

People who are looking to budget their income and allocate funds for different expenses.

03

Anyone who wants to have a clear understanding of their financial situation and make informed decisions about their spending habits.

Fill household monthly expenses form nj : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is list of household expenses?

A list of household expenses typically includes the following:

1. Rent or mortgage payments

2. Utilities (such as electricity, water, gas, and internet)

3. Insurance (homeowners/renters insurance, health insurance, car insurance)

4. Grocery bills

5. Transportation costs (fuel, public transportation fares, car maintenance)

6. Cell phone and landline expenses

7. Cable or satellite TV bills

8. Internet and streaming service subscriptions

9. Household supplies (cleaning products, toiletries, paper products)

10. Personal care expenses (haircuts, grooming, beauty products)

11. Entertainment and leisure activities (dining out, movies, concerts)

12. Clothing and shoes

13. Education expenses (school supplies, tuition fees, textbooks)

14. Healthcare costs (medication, doctor's visits, dental care)

15. Home maintenance and repairs

16. Furniture and home appliances

17. Pet supplies and veterinary expenses

18. Debt repayments (credit card bills, student loans, personal loans)

19. Property taxes

20. Retirement savings or investments

This is not an exhaustive list, as household expenses can vary based on individual circumstances. It is important to create a budget and track expenses to get a clear understanding of where the money is being spent.

Who is required to file list of household expenses?

The person who is required to file a list of household expenses depends on the context. In general, it is advisable for the person responsible for managing the household finances, such as the head of the household or the person designated for this task, to compile and keep track of the list of household expenses. This may include items such as rent or mortgage payments, utilities, groceries, transportation costs, insurance, and other household bills. However, there may be specific circumstances where other individuals, such as an accountant or financial advisor, need to file or review the list of household expenses for various purposes, such as tax filings or financial planning.

How to fill out list of household expenses?

1. Start by gathering all necessary documents and information related to your household expenses. This may include your bank statements, utility bills, rent or mortgage payments, insurance bills, and receipts for groceries and other expenses.

2. Create a list of categories for your household expenses. Some common categories include:

- Housing: Rent or mortgage payments, property taxes, homeowners or renters insurance.

- Utilities: Electricity, gas, water, internet, phone bills.

- Transportation: Car payments, fuel, car insurance, registration, public transportation fees.

- Food: Groceries, dining out, snacks.

- Health and medical: Health insurance premiums, co-pays, medications, doctor visits.

- Personal care: Haircuts, grooming products, cosmetics, clothing.

- Education: Tuition fees, school supplies, textbooks.

- Entertainment: Cable or streaming services, movie tickets, outings.

- Debt payments: Credit card bills, loan payments.

- Miscellaneous: Any other household expenses not covered by the above categories, such as gifts, subscriptions, or memberships.

3. Go through each category one by one and look at your documents to identify the specific expenses incurred. Write down each expense item and its corresponding cost next to the relevant category.

4. Be as specific as possible when filling out the list. For instance, instead of listing "groceries" as a single item, break it down into more specific categories like "meat," "vegetables," or "snacks." This will provide a more detailed and accurate representation of your spending habits.

5. Use a spreadsheet or budgeting app to help you organize your expenses. These tools provide a clear format for recording and tracking expenses, and they can automatically calculate totals and generate charts or graphs for better visualization.

6. Update your list regularly by adding new expenses and removing or adjusting old ones. This will help you maintain an accurate record of your household expenses over time.

7. Review your list periodically to analyze your spending habits, identify areas where you can cut costs or save money, and make necessary adjustments to your budget.

8. Consider using budgeting techniques like the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings or debt repayment. This will help you allocate your resources effectively and prioritize your expenses accordingly.

What is the purpose of list of household expenses?

The purpose of a list of household expenses is to track and manage the costs associated with running a household. It helps individuals or families understand and organize their spending, prioritize their financial goals, and make informed budgeting decisions. It provides a clear overview of where money is being allocated, allowing for adjustments and potential savings. Additionally, a list of household expenses aids in identifying areas where costs can be reduced or eliminated, leading to better financial management and potentially increasing savings or disposable income.

What information must be reported on list of household expenses?

When creating a list of household expenses, it is important to include the following information:

1. Category: Categorize each expense item to make it easier to track and analyze your spending patterns. Common categories include housing, utilities, groceries, transportation, debt payments, insurance, healthcare, entertainment, etc.

2. Description: Provide a brief description of each expense item, such as rent/mortgage, electricity bill, groceries, gas/transportation, credit card payment, medical expenses, Netflix subscription, etc.

3. Amount: Specify the cost or amount spent on each expense item. This could be a monthly or an average amount, depending on the expense.

4. Frequency: Indicate how often the expense occurs, whether it is a monthly, weekly, or annual expense. This will help in budgeting and planning for future periods.

5. Payment Method: Note the payment method used for each expense, such as cash, credit card, check, or online transfer. This can help you track spending habits and manage your payment methods effectively.

6. Due Date: If applicable, include the due date for bills or recurring expenses. This will ensure timely payments and help avoid late fees or penalties.

7. Notes: Optionally, you can include additional notes or comments about specific expenses, such as any particular reasons for higher or lower amounts, changes in expenses compared to previous periods, or any other relevant details.

By including the above information, you can create a comprehensive list of household expenses that will enable you to analyze your spending, identify areas for potential savings, and manage your budget efficiently.

What is the penalty for the late filing of list of household expenses?

The penalty for the late filing of a list of household expenses can vary depending on the jurisdiction and specific regulations in place. In some cases, there may be a specific monetary fine imposed for late filing, while in others there may be additional consequences such as interest charges or loss of certain benefits or deductions. It is advisable to consult the specific regulations and guidelines of the jurisdiction in question or seek professional advice to determine the exact penalty for late filing of household expenses.

How can I manage my printable list of monthly expenses directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your household monthly expense form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an eSignature for the expenses list in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your additional living expenses worksheet and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit list of daily expenses on an iOS device?

You certainly can. You can quickly edit, distribute, and sign household monthly expense form nj on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your printable list of monthly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expenses List is not the form you're looking for?Search for another form here.

Keywords relevant to list of household expenses template form

Related to basic living expenses list

If you believe that this page should be taken down, please follow our DMCA take down process

here

.