What is Monthly Budget Template?

A Monthly Budget Template is a tool that helps individuals or businesses track and manage their income and expenses on a monthly basis. It provides a structured framework for budgeting and allows users to set financial goals, monitor spending habits, and make informed decisions about their finances.

What are the types of Monthly Budget Template?

Monthly Budget Templates come in various types to cater to different financial needs and preferences. Some common types include:

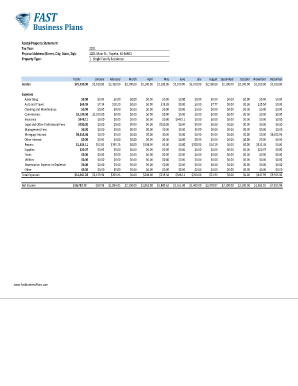

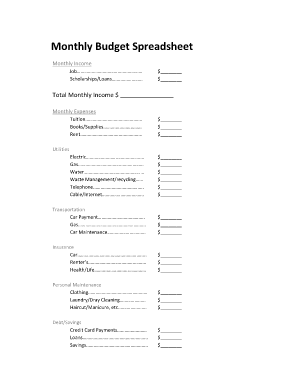

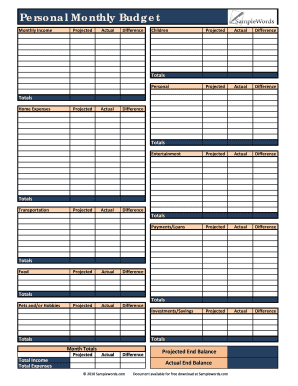

Basic Monthly Budget Template: This type of template provides a simple and straightforward layout for tracking income and expenses.

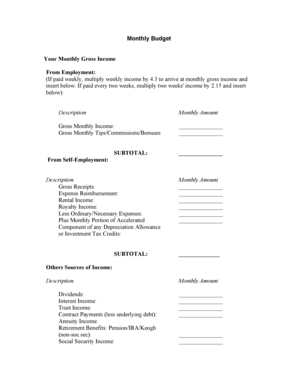

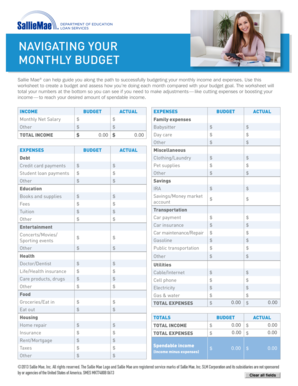

Detailed Monthly Budget Template: For users who prefer a more comprehensive approach, this template includes categories for various expenses such as housing, transportation, groceries, etc.

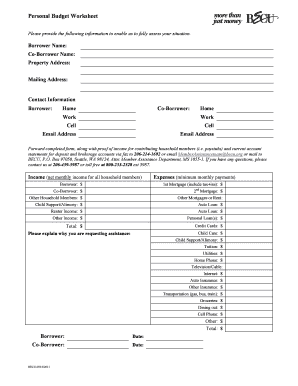

Family Monthly Budget Template: Designed specifically for families, this template includes sections for tracking childcare expenses, education costs, and other family-related expenses.

Project-based Monthly Budget Template: Ideal for individuals or businesses working on specific projects, this template allows for budgeting and tracking expenses related to a particular project or event.

Digital Monthly Budget Template: With the advent of technology, digital templates have become increasingly popular. These templates can be easily accessed, edited, and shared online.

How to complete Monthly Budget Template

Completing a Monthly Budget Template is a simple and effective way to gain control over your financial situation. Here are the steps to follow:

01

Gather all necessary financial documents, such as bank statements, pay stubs, and bills.

02

Identify your sources of income and record them in the template.

03

List all your fixed expenses, such as rent/mortgage, utilities, loan payments, etc.

04

Record your variable expenses, such as groceries, entertainment, dining out, etc.

05

Subtract your expenses from your income to determine your net cash flow.

06

Analyze your budget and identify areas where you can cut back on spending or allocate more funds.

07

Make adjustments to your budget as needed to ensure it aligns with your financial goals.

08

Regularly update and track your expenses to stay on top of your budget.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.