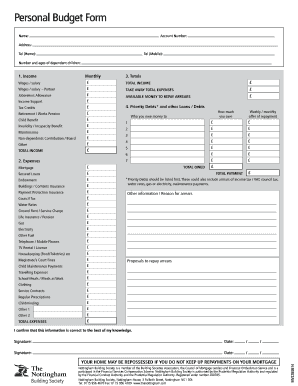

What is Personal Monthly Budget Template?

A Personal Monthly Budget Template is a helpful tool that allows individuals to track and manage their personal finances. It is a pre-designed spreadsheet or document that helps users organize their income, expenses, and savings on a monthly basis. With a Personal Monthly Budget Template, users can easily monitor their spending, identify areas where they can save, and set financial goals.

What are the types of Personal Monthly Budget Template?

There are several types of Personal Monthly Budget Templates available to suit different financial needs and preferences. Some common types include:

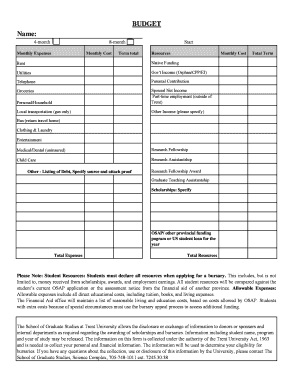

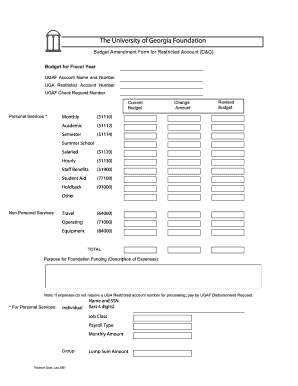

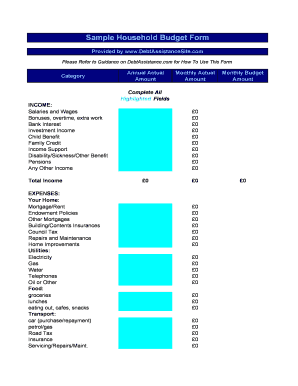

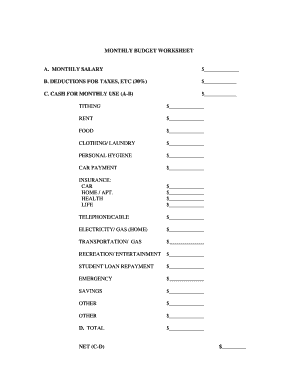

Basic Monthly Budget Template: This type of template provides a simple layout for tracking income and expenses.

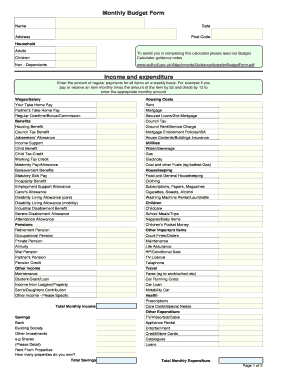

Detailed Monthly Budget Template: This template offers a more comprehensive approach, allowing users to record and analyze various categories of expenses in detail.

Family Monthly Budget Template: Designed specifically for families, this template enables users to manage the finances of multiple individuals and track shared expenses.

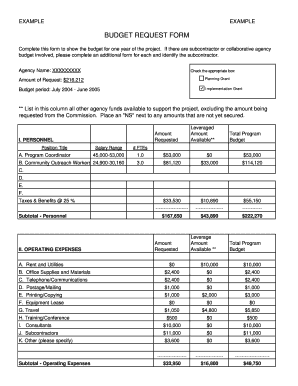

Business Monthly Budget Template: Ideal for entrepreneurs or self-employed individuals, this template helps keep track of business income, expenses, and profits.

Student Monthly Budget Template: Geared towards students, this template focuses on managing limited income and prioritizing expenses such as tuition, textbooks, and living costs.

How to complete Personal Monthly Budget Template

Completing a Personal Monthly Budget Template is straightforward and can be done in a few easy steps:

01

Gather all your financial documents, including pay stubs, bills, bank statements, and receipts.

02

Enter your total monthly income in the designated section of the template.

03

List all your monthly expenses, such as rent/mortgage, utilities, groceries, transportation, entertainment, and debt payments.

04

Categorize your expenses and allocate a budget for each category to ensure you don't overspend.

05

Continuously track your actual expenses throughout the month and adjust your budget as needed.

06

Regularly review your budget to identify areas where you can save money and make necessary adjustments.

pdfFiller, a leading online document management platform, offers a user-friendly solution for creating, editing, and sharing Personal Monthly Budget Templates. With a vast library of fillable templates and powerful editing tools, pdfFiller empowers users to effortlessly manage their finances and achieve their financial goals.