What is a printable mileage log book?

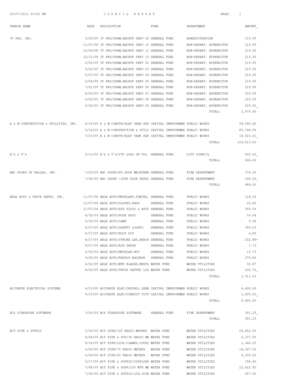

A printable mileage log book is a document used to track the distance traveled by a vehicle for business or personal use. It serves as a record of the dates, locations, and purpose of each trip, as well as the total number of miles driven. By keeping a mileage log book, individuals or companies can accurately calculate the deductions or reimbursements they are entitled to.

What are the types of printable mileage log book?

There are several types of printable mileage log books available, each designed to cater to different needs. Some common types include:

Traditional paper log books: These are physical log books printed on paper, where individuals manually record the necessary information.

Excel or spreadsheet templates: These are digital log books created using spreadsheet software like Microsoft Excel, which allows for easier data entry and calculations.

Mobile apps: There are various mobile applications available that offer mileage tracking features, allowing users to conveniently record their trips using their smartphones.

Online platforms: Certain online platforms, such as pdfFiller, provide printable mileage log book templates that can be filled out and stored digitally.

How to complete a printable mileage log book

Completing a printable mileage log book is a straightforward process. Here are the basic steps involved:

01

Start by entering the date of each trip. This helps to keep track of when the travel occurred.

02

Note down the starting point and destination of the trip. This information is necessary for calculating the distance traveled.

03

Specify the purpose of each trip. Whether it's for a client meeting, business errand, or personal travel, recording the purpose helps in determining the type of mileage deduction or reimbursement.

04

Record the starting and ending mileage of the vehicle for each trip. The difference between the two provides the total miles driven.

05

Include any additional notes or details relevant to the trip. This can include toll expenses, parking fees, or any special circumstances.

06

Periodically review and summarize the information in the log book to generate reports or calculate deductions/reimbursements.

In order to simplify the process of creating and managing printable mileage log books, pdfFiller offers a comprehensive online solution. With unlimited fillable templates and powerful editing tools, pdfFiller empowers users to effortlessly create, edit, and share their documents. It is the only PDF editor users need to get their documents done efficiently and effectively.