Travel Expense Report With Mileage Log

What is Travel Expense Report With Mileage Log?

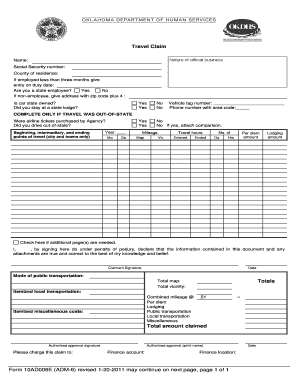

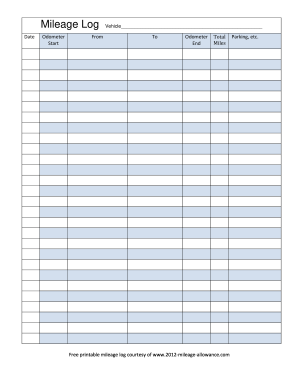

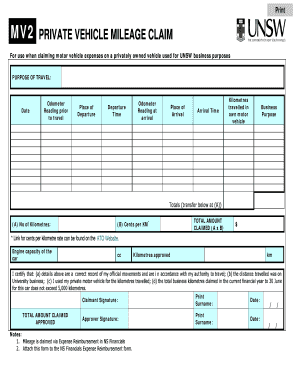

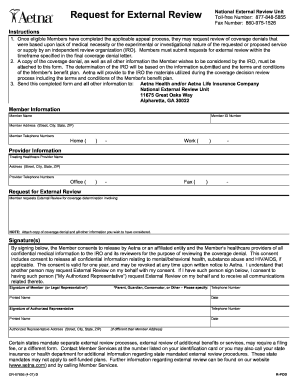

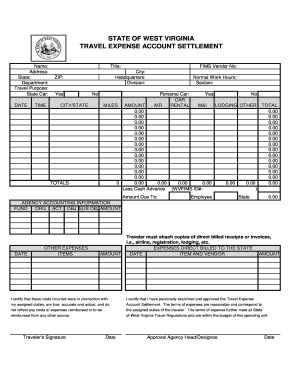

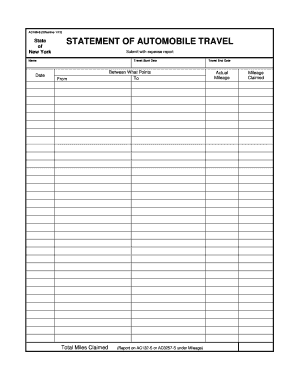

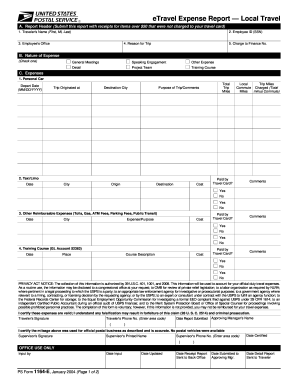

A Travel Expense Report With Mileage Log is a document used to track and report travel expenses and mileage incurred during business trips. It allows employees to record and submit their expenses for reimbursement purposes. This report helps both the employee and the company keep track of travel expenses and ensures accurate reimbursement.

What are the types of Travel Expense Report With Mileage Log?

There are different types of Travel Expense Reports With Mileage Log that can be used depending on the specific requirements of a company. Some common types include:

How to complete Travel Expense Report With Mileage Log

To complete a Travel Expense Report With Mileage Log, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.