Profit And Loss Statement For Self Employed Template Free - Page 2

What is Profit And Loss Statement For Self Employed Template Free?

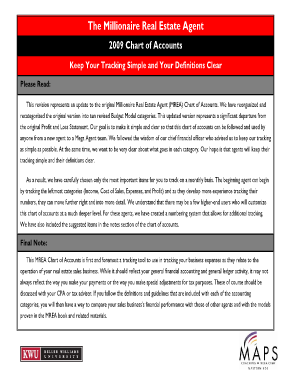

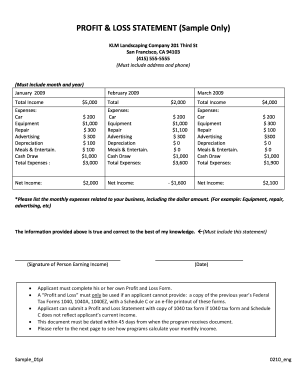

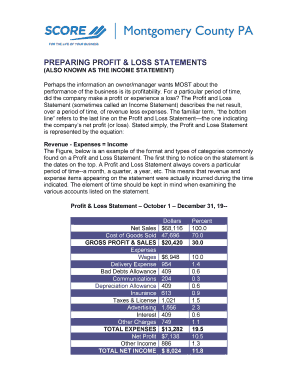

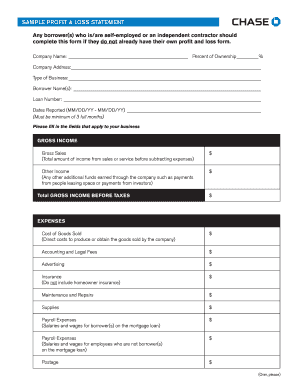

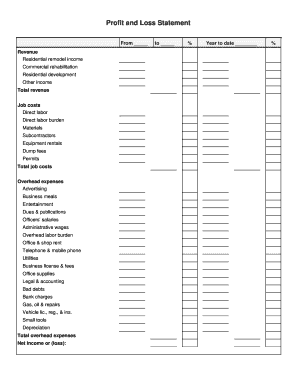

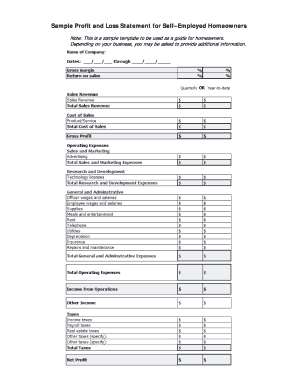

A Profit and Loss Statement for Self Employed Template Free is a document that summarizes the revenues, costs, and expenses incurred by a self-employed individual or business. It provides an overview of the financial performance over a specific period, usually a year. This statement is essential for tracking the profitability and financial health of the self-employed individual or business.

What are the types of Profit And Loss Statement For Self Employed Template Free?

There are several types of Profit and Loss Statement for Self Employed Template Free available, each catering to specific needs and preferences. Some common types include:

How to complete Profit And Loss Statement For Self Employed Template Free?

Completing a Profit and Loss Statement for Self Employed Template Free involves several steps. Here's a step-by-step guide to help you:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.