What is profit and loss form 2016?

Profit and Loss Form 2016 is a financial document that summarizes the revenues, costs, and expenses incurred by a company during the year 2016. It provides valuable insights into the financial performance of a business and helps in assessing its profitability. By analyzing the form, businesses can identify areas of improvement and make informed decisions to maximize their profits in the future.

What are the types of profit and loss form 2016?

There are several types of profit and loss forms that businesses can use for reporting their financial information for the year 2016. Some common types include:

Single-step income statement: This form reports all revenues and gains on one side and all expenses and losses on the other side.

Multi-step income statement: This form provides more detailed information by separating operating expenses, non-operating expenses, revenues, and gains.

Comparative income statement: This form compares the financial data of two or more years, allowing businesses to analyze their performance over time.

Contribution margin income statement: This form focuses on the contribution margin, which is the difference between sales revenue and variable costs.

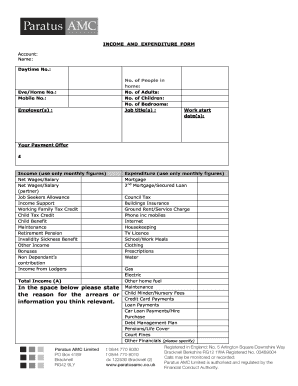

How to complete profit and loss form 2016

Completing the profit and loss form for the year 2016 requires attention to detail and accuracy. Here are the steps to follow:

01

Gather all relevant financial documents such as sales records, expense receipts, and bank statements.

02

Start by filling in the basic information at the top of the form, including the name of the business, the reporting period (2016), and the currency used.

03

Enter the revenues and gains in the appropriate sections of the form. Be sure to categorize them correctly and provide supporting documentation if required.

04

Next, enter the various types of expenses and losses in their respective sections, making sure to classify them accurately.

05

Calculate the net income or loss by subtracting the total expenses and losses from the total revenues and gains.

06

Review the completed form for any errors or missing information. Make necessary adjustments and ensure all calculations are accurate.

07

Sign and date the form, indicating your acknowledgment and authorization of the provided financial information.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.