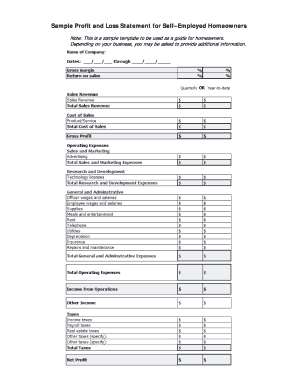

Profit And Loss Statement Form - Page 2

What is Profit And Loss Statement Form?

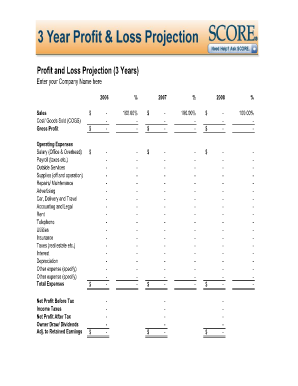

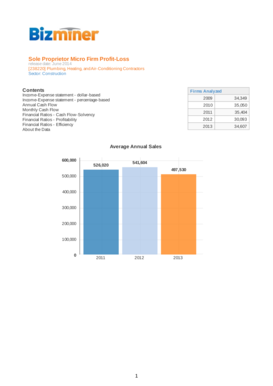

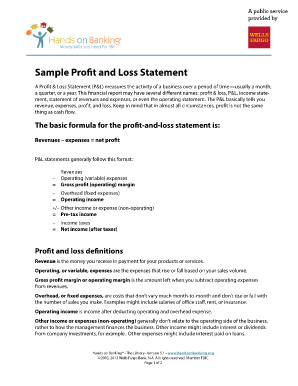

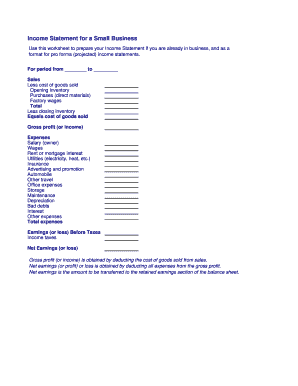

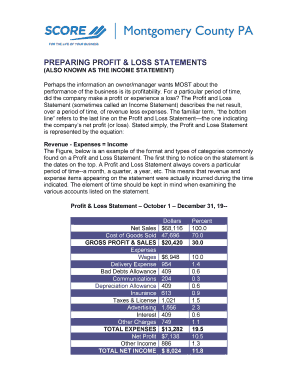

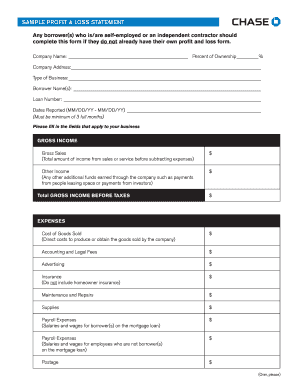

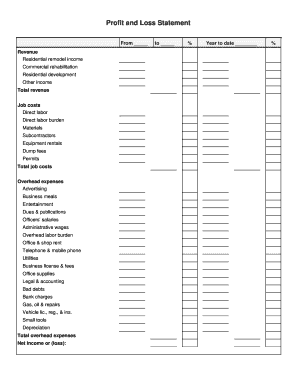

A Profit and Loss Statement Form, also known as an income statement or operating statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time. It provides valuable insights into the financial performance and profitability of a business.

What are the types of Profit And Loss Statement Form?

There are several types of Profit and Loss Statement Forms, which may vary based on the specific needs and requirements of a business. The most common types include:

How to complete Profit And Loss Statement Form

Completing a Profit and Loss Statement Form can be done effectively by following these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.