Monthly Profit And Loss Statement

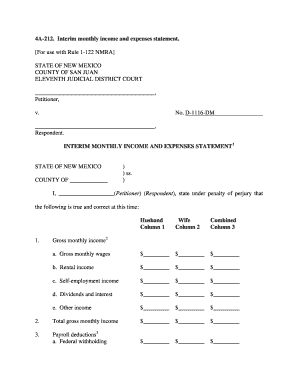

What is monthly profit and loss statement?

A monthly profit and loss statement, also known as an income statement or P&L statement, is a financial statement that shows the revenues, expenses, and net profit or loss of a business for a specific month. It provides a clear snapshot of a company's financial performance and helps in evaluating its profitability.

What are the types of monthly profit and loss statement?

There are various types of monthly profit and loss statements that cater to different industries and business structures. Some common types include: 1. Single-Step: This type presents all the revenues and gains as well as all the expenses and losses in a single section, providing a simplified view of the financial performance. 2. Multi-Step: This type breaks down the revenues, expenses, gains, and losses into multiple sections, offering a more detailed analysis of the company's financial performance. 3. Comparative: This type compares the financial performance of the current month with the previous months or a specific period, allowing businesses to track their progress over time.

How to complete monthly profit and loss statement

Completing a monthly profit and loss statement involves the following steps: 1. Gather all relevant financial data: Collect all the necessary information, such as sales figures, expenses, and other income sources. 2. Calculate revenues: Determine the total amount of money earned from sales, services, and any other income sources during the specified month. 3. Calculate expenses: Calculate the total amount spent on operating expenses, such as rent, utilities, salaries, and marketing. 4. Calculate net profit or loss: Subtract the total expenses from the total revenues to get the net profit or loss for the month. 5. Review and analyze: Evaluate the financial performance, identify any trends, and make necessary adjustments to improve profitability.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.