Promissory Note Templates - Page 2

What are Promissory Note Templates?

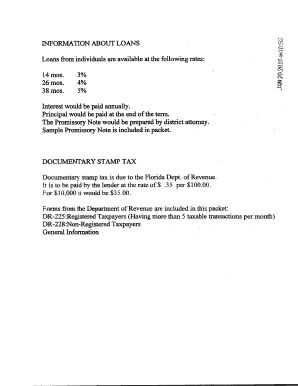

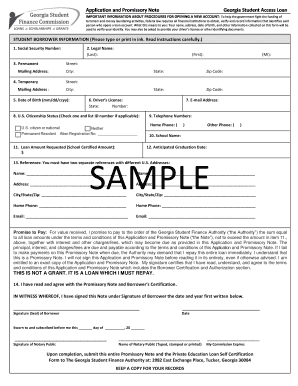

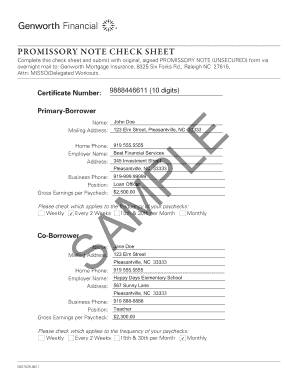

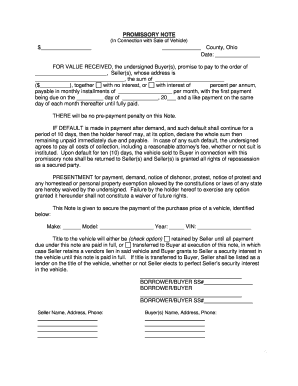

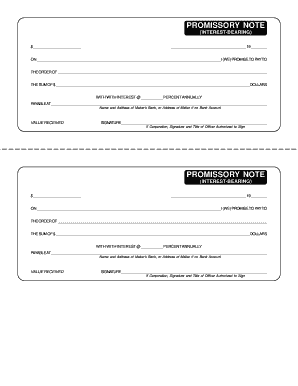

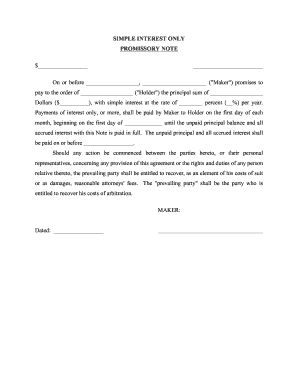

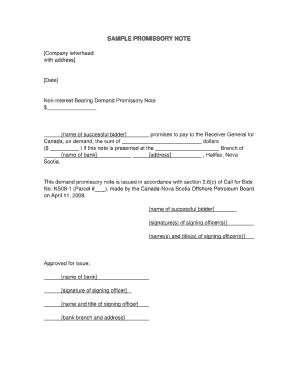

Promissory Note Templates refer to pre-designed documents that outline the terms and conditions of a loan agreement between two parties. These templates provide a convenient and efficient way to create legally binding promissory notes, eliminating the need for extensive manual documentation.

What are the types of Promissory Note Templates?

There are several types of Promissory Note Templates available, each tailored to meet specific lending requirements. Some common types include:

How to complete Promissory Note Templates

Completing Promissory Note Templates is a straightforward process. Here are the steps to follow:

pdfFiller simplifies the process of creating, editing, and sharing Promissory Note Templates. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate PDF editor that allows users to easily manage their loan agreements.