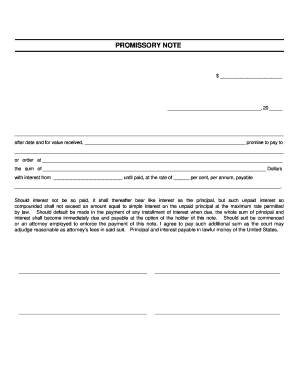

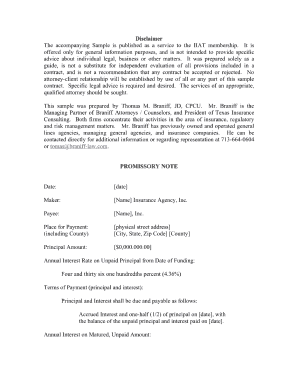

Promissory Notes Templates

What are Promissory Notes Templates?

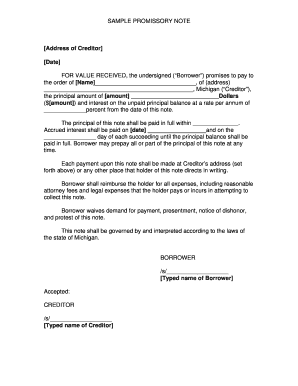

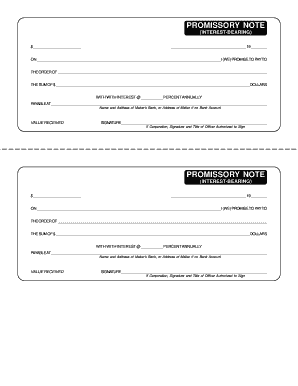

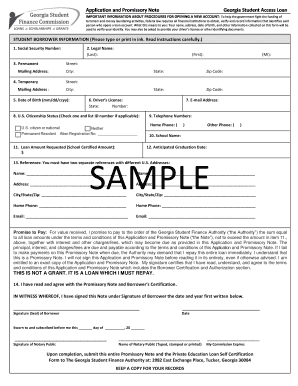

Promissory Notes Templates are standardized forms that individuals can use to create legally binding agreements between two parties. These templates provide a framework for documenting the terms and conditions of a loan or debt repayment, including the amount borrowed, interest rate, payment schedule, and other necessary details. By using a Promissory Note Template, individuals can easily draft a professional agreement without the need for extensive legal knowledge or expensive legal assistance.

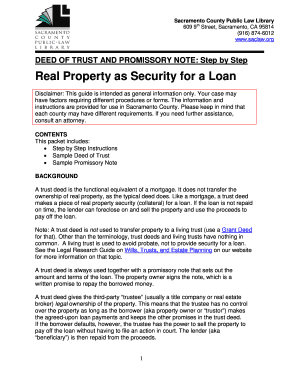

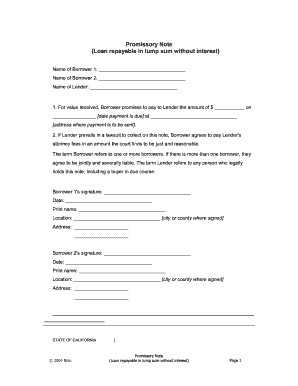

What are the types of Promissory Notes Templates?

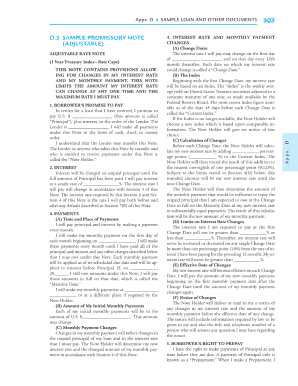

There are several types of Promissory Notes Templates available to cater to different lending scenarios. Some common types include:

How to complete Promissory Notes Templates

Completing a Promissory Note Template is a straightforward process. Here are the steps to follow:

With pdfFiller's online platform, users can easily create and customize Promissory Notes Templates. By offering unlimited fillable templates and powerful editing tools, pdfFiller simplifies the process of creating legally binding agreements. With pdfFiller, you can confidently draft, edit, and share your Promissory Notes with ease.