Rent To Own House How Does It Work

What is rent to own house how does it work?

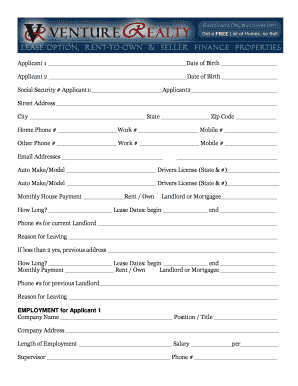

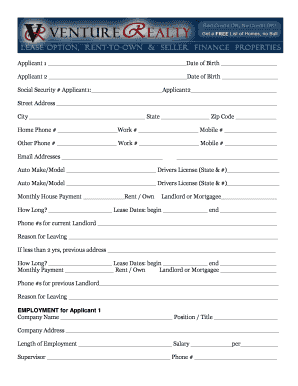

Rent to own housing is a unique agreement that allows individuals to rent a property with the option to purchase it in the future. This arrangement combines aspects of both renting and buying a home, offering certain benefits to both parties involved. The process begins with the tenant signing a lease agreement, which includes a provision allowing them to buy the property at an agreed-upon price within a specified period. During the rental period, a portion of the rent goes towards a down payment or credits that can be used towards the purchase price. This gives renters the opportunity to build equity while living in the property. If the tenant decides not to exercise the option to buy, they can simply continue renting the property as per the terms of the lease.

What are the types of rent to own house how does it work?

Rent to own homes can come in various forms, catering to different needs and circumstances. The two main types are lease option agreements and lease purchase agreements. In a lease option agreement, the tenant has the option to buy the property but is not obligated to do so. This gives them the flexibility to back out if they change their mind or face financial constraints. On the other hand, a lease purchase agreement requires the tenant to buy the property at the end of the lease term. This type of agreement is more binding and suits individuals who are certain about their intention to purchase the property. Both types offer the opportunity to rent a property while working towards homeownership.

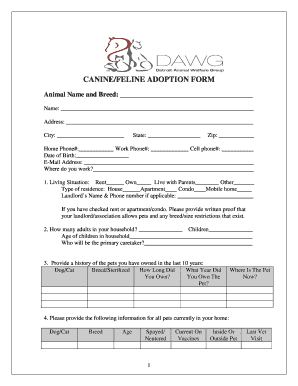

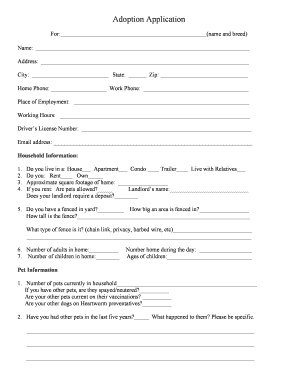

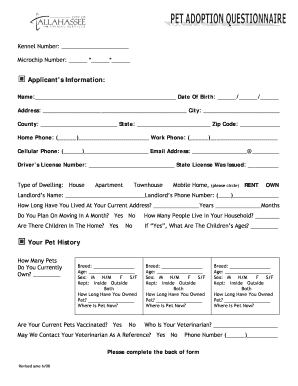

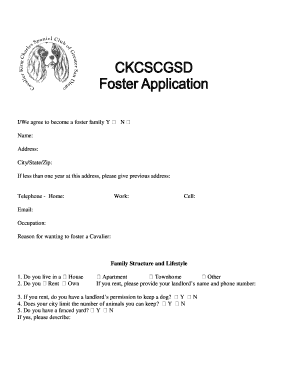

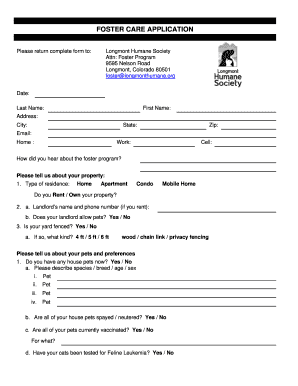

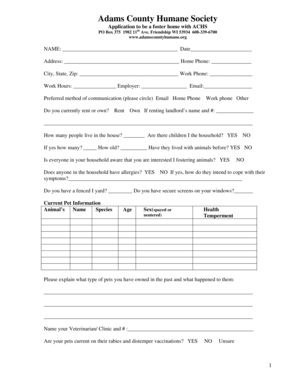

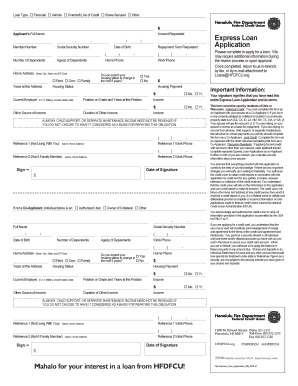

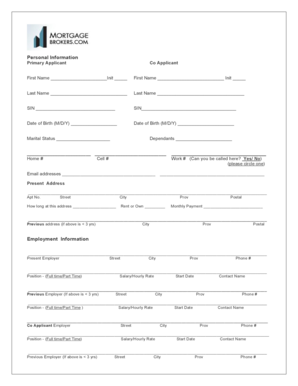

How to complete rent to own house how does it work

Completing a rent to own house agreement involves a few essential steps. Here's a simple guide to help you through the process:

In summary, rent to own housing offers a unique opportunity for individuals to rent a property while working towards homeownership. pdfFiller is here to assist you in the process by empowering you to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.