Rent To Own Agreement Definition

What is rent to own agreement definition?

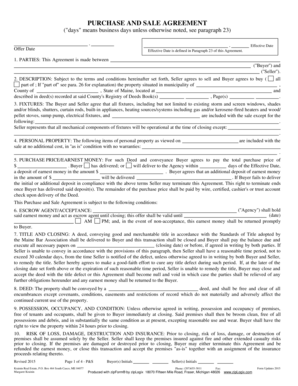

A rent to own agreement, also known as a lease-purchase agreement or a lease option agreement, is a contract between a landlord and a tenant that allows the tenant to eventually purchase the property they are currently renting. This type of agreement combines elements of a traditional rental agreement and a home purchase agreement.

What are the types of rent to own agreement definition?

There are two main types of rent to own agreements: 1. Lease-purchase agreement: In this type, the tenant agrees to purchase the property at the end of the lease term. 2. Lease option agreement: In this type, the tenant has the option to purchase the property at the end of the lease term, but is not obligated to do so. They can choose to walk away from the agreement without any penalty.

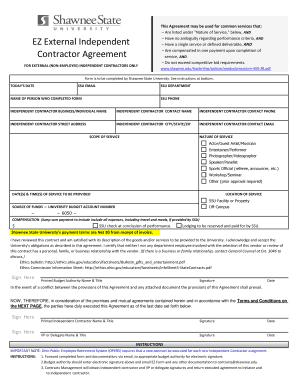

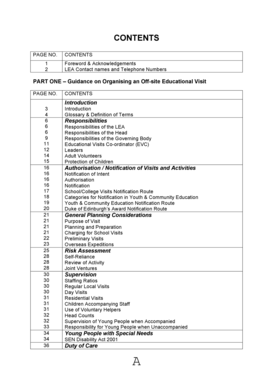

How to complete rent to own agreement definition

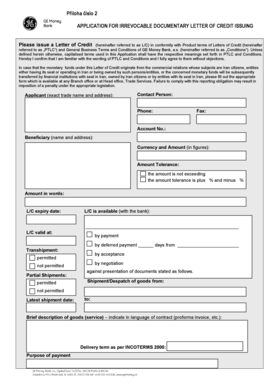

To complete a rent to own agreement, follow these steps: 1. Determine the terms: Decide on the lease term, purchase price, and the amount of rent that will go towards the eventual purchase. 2. Include necessary clauses: Include clauses to protect both the landlord and the tenant, such as repair responsibilities, eviction procedures, and terms for breaking the agreement. 3. Get it in writing: Put the agreement in writing and have both parties sign it. 4. Consider legal advice: It may be helpful to consult with a real estate attorney to ensure the agreement is legally binding and covers all necessary details.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.