Sample Credit Report - Page 2

What is Sample Credit Report?

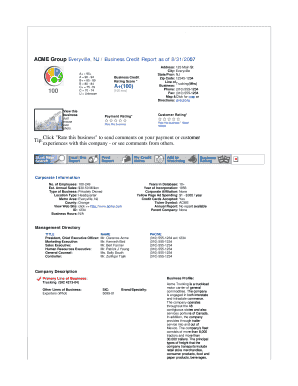

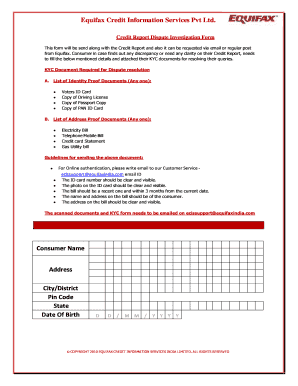

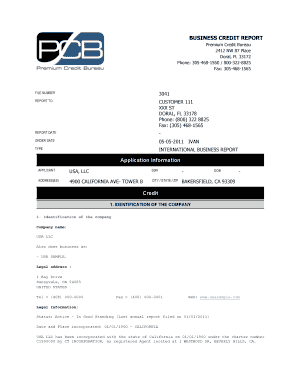

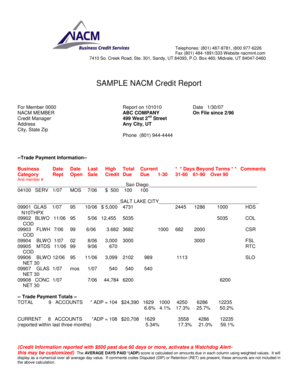

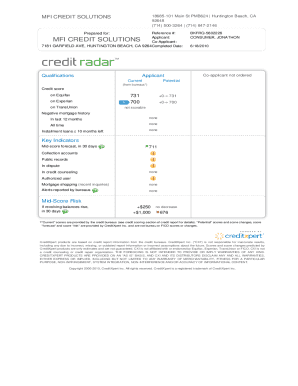

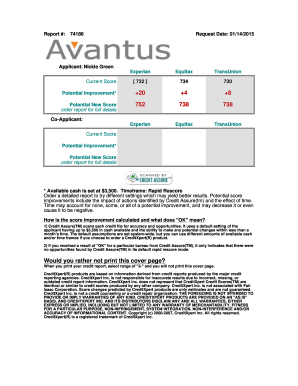

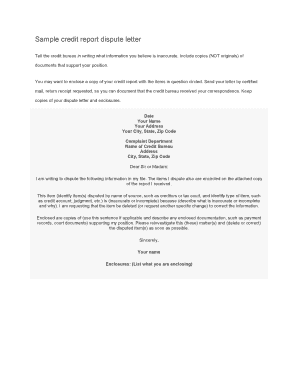

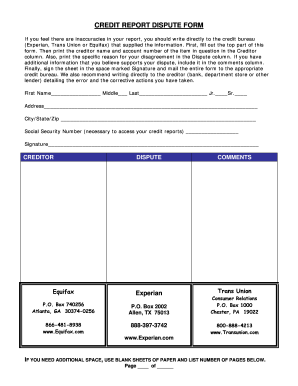

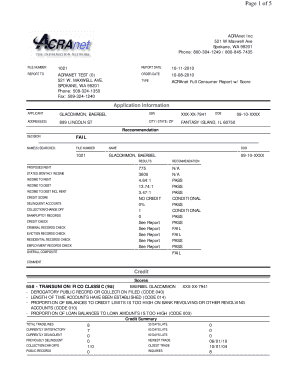

A Sample Credit Report is a comprehensive document that provides information about an individual's credit history. It includes details about their credit accounts, payment history, and any derogatory remarks or public records. Lenders and financial institutions use credit reports to assess a person's creditworthiness and determine whether they will be approved for a loan or credit card.

What are the types of Sample Credit Report?

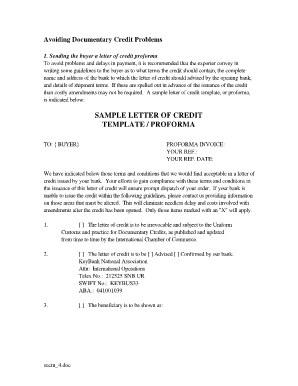

There are three major credit bureaus that generate credit reports: Equifax, Experian, and TransUnion. Each bureau may have slightly different formats and information included in their reports, but the overall content is similar. The types of information you can expect to find in a Sample Credit Report include personal identifying information, credit account details, payment history, public records such as bankruptcies or tax liens, and inquiries made by lenders or other entities.

How to complete Sample Credit Report

To complete a Sample Credit Report, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.