What is a sample mortgage promissory note?

A sample mortgage promissory note is a legal document that outlines the terms and conditions of a loan secured by a mortgage on a property. It serves as a written promise from the borrower to repay the loan amount, including any interest and fees, to the lender within a specified period of time. The promissory note also includes details such as the loan amount, interest rate, repayment schedule, and consequences for defaulting on the loan.

What are the types of sample mortgage promissory note?

There are several types of sample mortgage promissory notes that cater to different borrowing situations:

Fixed-Rate Promissory Note: This type of note has a fixed interest rate throughout the loan term, which means the borrower's monthly payments remain consistent.

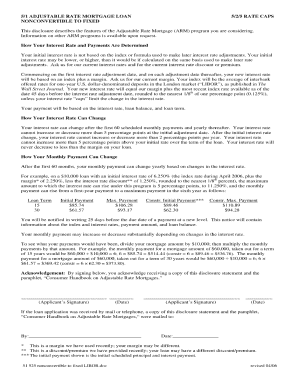

Adjustable-Rate Promissory Note: With this note, the interest rate is subject to change based on market conditions. The borrower's monthly payments may vary accordingly.

Balloon Promissory Note: In this type of note, the borrower makes smaller monthly payments for a specified period and then pays off the remaining balance in a lump sum at the end of the loan term.

Interest-Only Promissory Note: This note allows the borrower to make payments that only cover the interest for a specified period before starting to repay the principal amount.

How to complete a sample mortgage promissory note

Completing a sample mortgage promissory note is a straightforward process. Here are the steps:

01

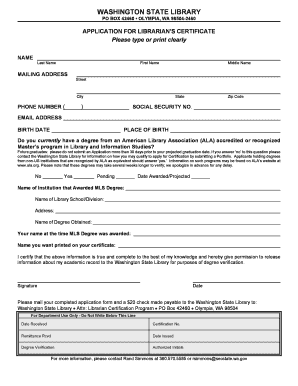

Gather necessary information: You'll need details such as the borrower's and lender's names, loan amount, interest rate, repayment schedule, and any additional terms and conditions.

02

Fill in the form: Using online tools like pdfFiller, you can easily fill in the required fields of the promissory note template. Make sure to review the document for accuracy before proceeding.

03

Review and sign the document: Carefully read through the completed promissory note to ensure all information is correct. Once satisfied, both the borrower and lender should sign the document to make it legally binding.

04

Keep a copy: It's vital for both parties to retain a copy of the signed promissory note for future reference and record-keeping purposes.

With pdfFiller, you can effortlessly create, edit, and share your mortgage promissory notes online. Its unlimited fillable templates and powerful editing tools make it the only PDF editor you'll need to get your documents done.