What is Standard Format Bank Guarantee?

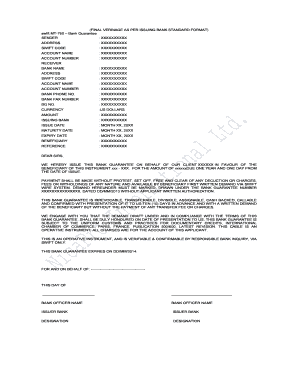

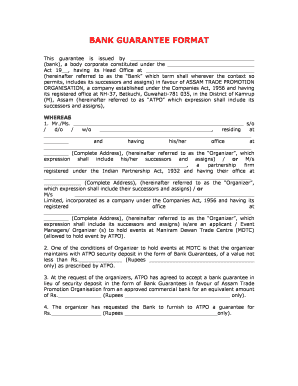

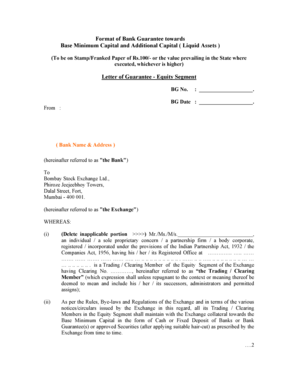

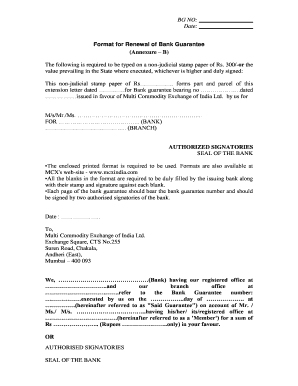

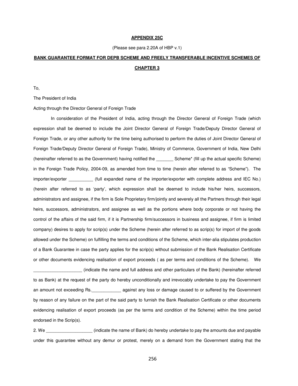

A Standard Format Bank Guarantee is a legally binding document issued by a bank on behalf of a customer, ensuring the payment of a specified amount to a beneficiary in the event that the customer fails to fulfill their contractual obligations. It serves as a form of security for the beneficiary, assuring them that they will receive compensation if the customer fails to meet their financial obligations.

What are the types of Standard Format Bank Guarantee?

There are several types of Standard Format Bank Guarantee, each designed to meet specific requirements. The most common types include:

Bid Bond Guarantee: A guarantee used in bidding processes to ensure that the winning bidder will enter into the contract and provide the necessary performance bonds.

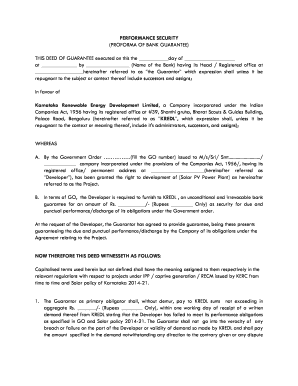

Performance Guarantee: A guarantee that ensures the completion of a contract according to its terms and conditions.

Advance Payment Guarantee: A guarantee provided by the bank to the customer's supplier, ensuring reimbursement in case of any failure from the customer's end.

Financial Guarantee: A guarantee issued to support financial obligations, such as loans or credit facilities.

Payment Guarantee: A guarantee given by the bank to the seller, ensuring payment in case the buyer fails to make the payment.

How to complete Standard Format Bank Guarantee

Completing a Standard Format Bank Guarantee requires careful attention to detail and adherence to established procedures. Here are the steps involved in completing a Bank Guarantee:

01

Gather all the necessary information and documentation required for the Bank Guarantee.

02

Draft the Bank Guarantee in accordance with the standard format, including all relevant details such as the beneficiary, amount, and validity period.

03

Submit the completed Bank Guarantee to the issuing bank for review and approval.

04

Pay any applicable fees or charges associated with the issuance of the Bank Guarantee.

05

Obtain the final approved Bank Guarantee from the issuing bank and provide it to the beneficiary.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.