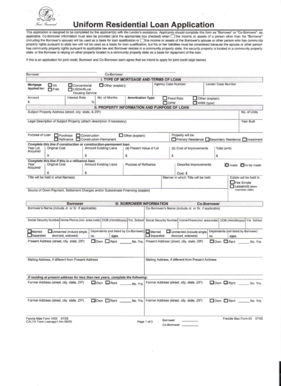

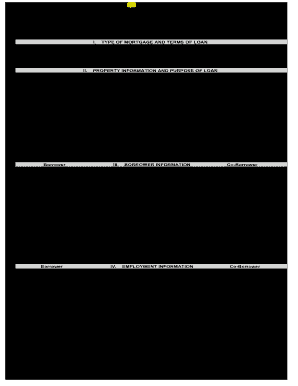

Uniform Residential Loan Application Instructions - Page 2

What is uniform residential loan application instructions?

Uniform Residential Loan Application Instructions refer to the guidelines that borrowers must follow when completing a loan application form for a residential mortgage. These instructions provide step-by-step guidance on how to properly fill out the application, ensuring that all required information is accurately provided.

What are the types of uniform residential loan application instructions?

The types of uniform residential loan application instructions may vary based on the specific lender or financial institution. However, some common types include: 1. General instructions: These instructions provide a general overview of how to complete the application form. 2. Specific instructions: These instructions highlight any additional information or specific requirements requested by the lender. 3. Documentation instructions: These instructions outline the supporting documents that need to be submitted along with the application form.

How to complete uniform residential loan application instructions

To complete the uniform residential loan application instructions, follow these steps: 1. Review the instructions carefully: Read through the instructions thoroughly before starting to fill out the application form. 2. Gather the required documents: Collect all the necessary documents as specified in the documentation instructions. 3. Provide accurate information: Fill out the application form accurately, ensuring that all information provided is correct and up to date. 4. Double-check for errors: Review the completed form for any errors or omissions before submitting it to the lender. 5. Submit the application: Once the form is completed and checked, submit it along with the required supporting documents to the lender.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.