What is new 1003 loan application 2017?

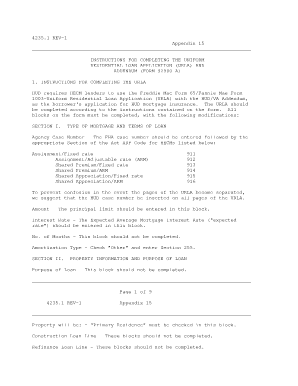

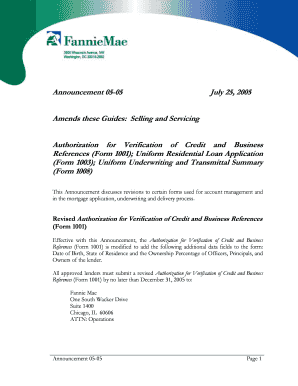

The new 1003 loan application for 2017 is an updated version of the standard loan application used by borrowers to apply for a mortgage. It includes several changes and additions to better align with current lending practices and regulations. This updated application provides lenders with more detailed information about the borrower's financial situation, credit history, and employment history, allowing for a more comprehensive assessment of their loan eligibility.

What are the types of new 1003 loan application 2017?

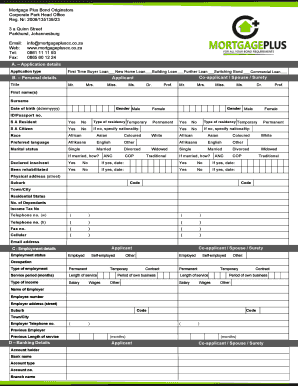

There are three main types of new 1003 loan application for 2017:

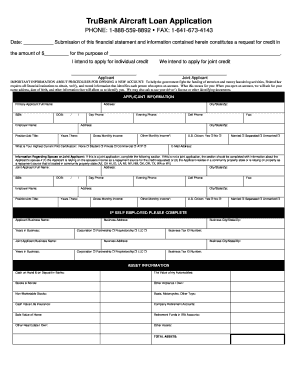

Full Application: This is the most detailed version of the loan application and requires borrowers to provide comprehensive information about their financial situation, employment history, assets, and liabilities.

Short Form Application: As the name suggests, this is a condensed version of the loan application that requires less detailed information. It is typically used for loan pre-approvals or when the borrower has already provided comprehensive information.

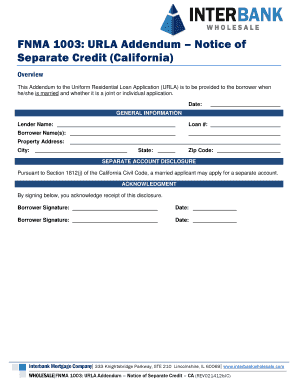

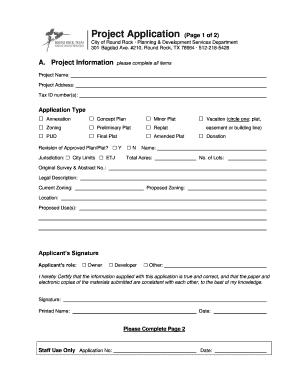

Online Application: Many lenders now offer an online version of the new 1003 loan application. This allows borrowers to easily complete and submit the application electronically, saving time and effort.

How to complete new 1003 loan application 2017

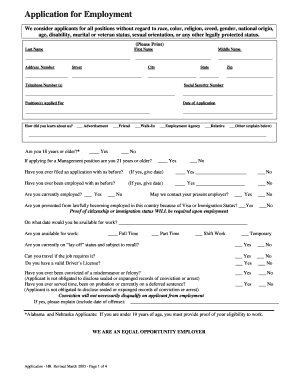

Completing the new 1003 loan application for 2017 is a straightforward process that can be broken down into the following steps:

01

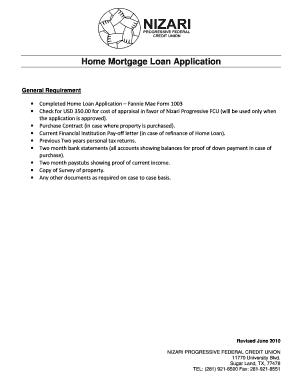

Gather all required documents and information, including pay stubs, bank statements, tax returns, and identification.

02

Fill out the application accurately and completely, providing all requested information.

03

Double-check all entries for any errors or omissions.

04

Review the application thoroughly before submitting to ensure all information is accurate and up to date.

05

Submit the completed application to your lender either in person or through their online application portal.

06

Keep a copy of the completed application and any supporting documents for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.