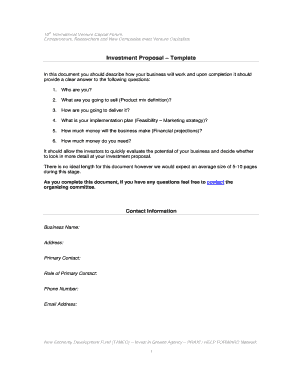

Venture Capital Proposal Template

What is Venture Capital Proposal Template?

A venture capital proposal template is a standardized document that outlines a business idea or project to potential investors in order to secure funding. It includes information such as the business concept, market analysis, financial projections, and investment opportunities.

What are the types of Venture Capital Proposal Template?

There are several types of venture capital proposal templates, each tailored to different industries and stages of business development. Some common types include: 1. Startup Venture Capital Proposal Template: Designed for early-stage startups seeking seed funding. 2. Expansion Venture Capital Proposal Template: Targeted at businesses looking to expand their operations. 3. Acquisition Venture Capital Proposal Template: Intended for companies seeking funding for acquiring other businesses. 4. Technology Venture Capital Proposal Template: Geared towards tech companies in need of capital for research and development.

How to complete Venture Capital Proposal Template

Completing a venture capital proposal template requires careful planning and attention to detail. Here are some steps to follow: 1. Research and understand your target audience: Identify potential investors and tailor your proposal to their specific interests. 2. Clearly define your business concept and goals: Explain what your business does, what problem it solves, and how it will generate revenue. 3. Conduct a thorough market analysis: Analyze your target market, competitors, and industry trends to demonstrate market potential. 4. Present financial projections: Provide detailed financial forecasts, including revenue projections, costs, and potential return on investment. 5. Showcase your team and experience: Highlight the qualifications and expertise of your management team. 6. Craft a compelling executive summary: Summarize the key points and benefits of your proposal in a concise and persuasive manner. 7. Review and revise: Proofread your proposal for errors, and seek feedback from mentors or advisors before finalizing it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.