Document Generation Tool for Reverse Mortgage Companies that puts time back into your workday

What makes pdfFiller an excellent Document Generation Tool for Reverse Mortgage Companies?

Trusted document generation solution

User-friendly and flexible Document Generation Tool for Reverse Mortgage Companies

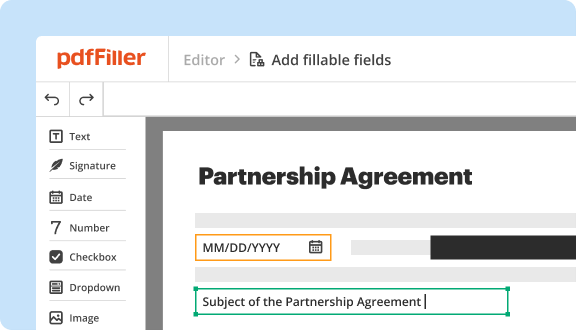

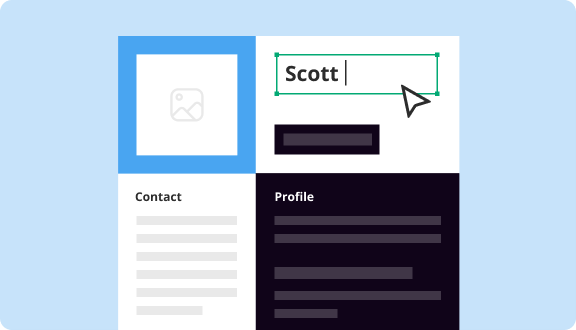

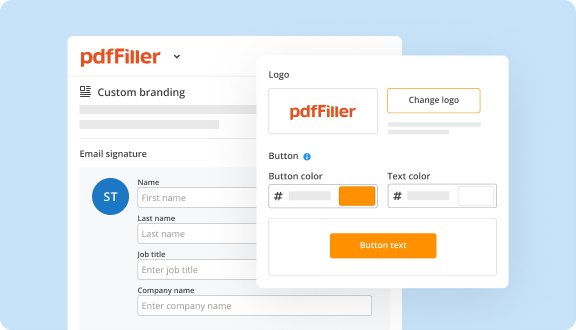

Regardless of whether you’re managing HR processes or organizing sales contracts, your documents should be organized and professional-looking. Even the most refined specialist may find it hard to take care of paperwork and forms if they do not have the appropriate document solution. Fortunately, pdfFiller’s Document Generation Tool for Reverse Mortgage Companies streamlines this procedure in minutes. Create, edit, eSign and safely store your documents with no moving among numerous software or spending money on obsolete capabilities. Put your document-centered procedures on the right track from day one of implementing the solution.

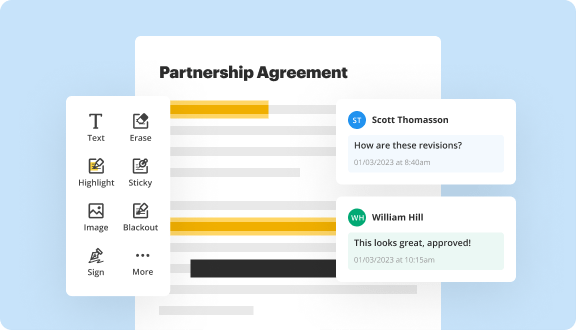

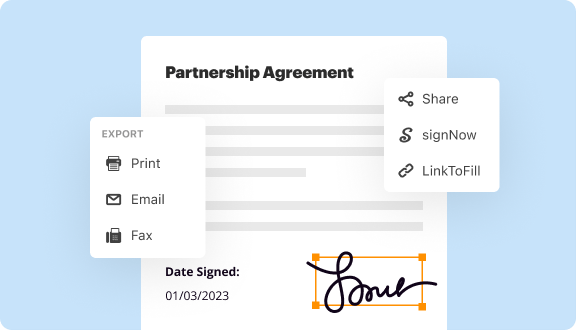

Get a superior Reverse Mortgage Companies Document Generation Tool. Facilitate document collaboration and communication throughout your organization, paving the way for faster document turnaround and procedure transparency. Simply track your document’s progress, remove manual errors, and improve process quality and effectiveness.

Six simple steps to make use of Document Generation Tool for Reverse Mortgage Companies

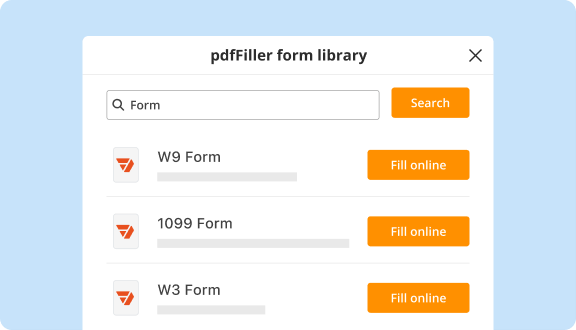

Find the most relevant and compliant tools and features that make PDF document management fast, practical, and secure. Create reusable document Templates, share them with your team, and invite your team work with high-priority documents. Begin your free trial version and investigate Document Generation Tool for Reverse Mortgage Companies right now.

Every document generation tool you need to move your business forward

Why pdfFiller wins

Cloud-native PDF editor

Top-rated for ease of use

Unlimited document storage

Unmatched cost-to-value

Industry-leading customer service

Security & compliance

Streamline Your Workflow with Our Document Generation Tool for Reverse Mortgage Companies

Are you tired of spending valuable time creating documents manually? Our Document Generation Tool for Reverse Mortgage Companies is designed to give you more time in your workday. By automating document creation, you can focus on what truly matters—serving your clients.

Key Features

Use Cases and Benefits

Our tool addresses common challenges in document management, such as time inefficiency and error-prone manual processes. By leveraging automation, you can streamline your operations, allowing you to respond more quickly to client needs. In turn, this fosters stronger relationships and boosts your company's reputation in the reverse mortgage sector.