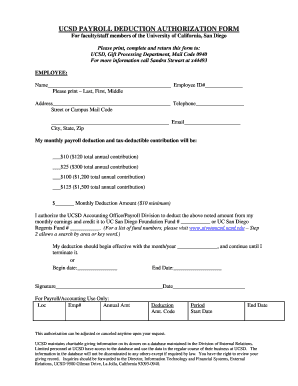

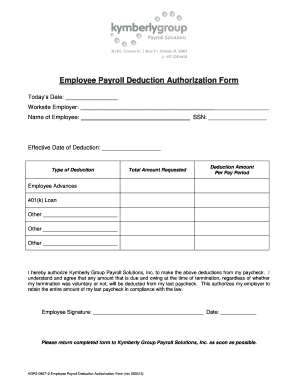

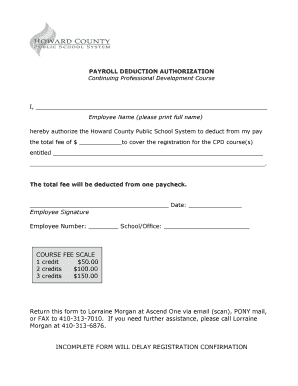

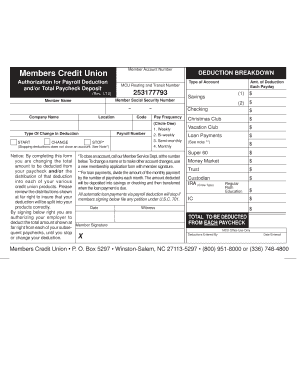

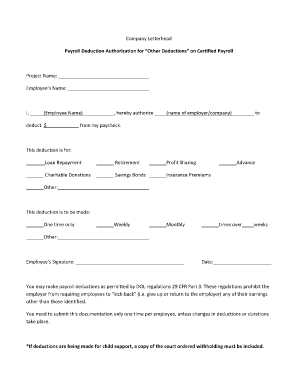

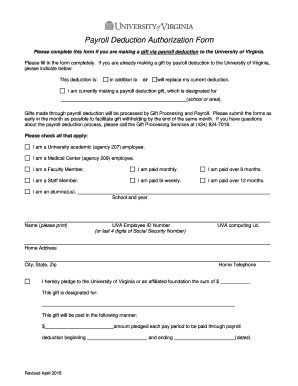

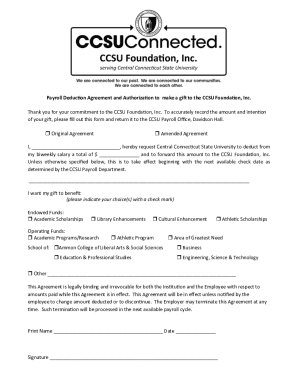

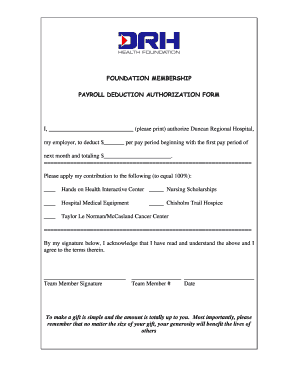

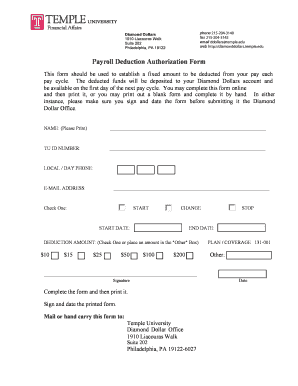

Customize and complete your essential Payroll Deduction Authorization template

Prepare to streamline document creation using our fillable Payroll Deduction Authorization template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

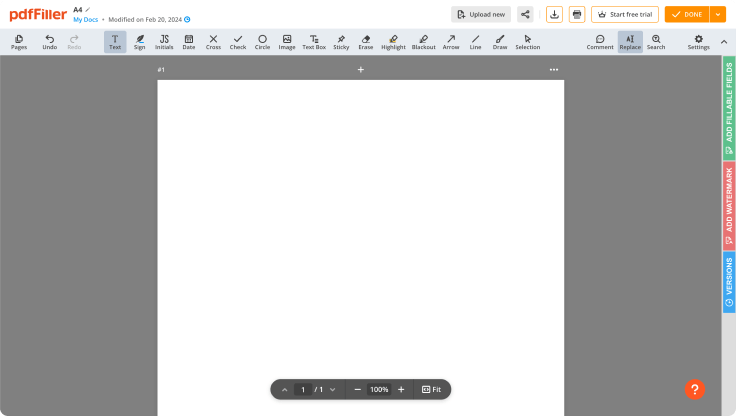

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

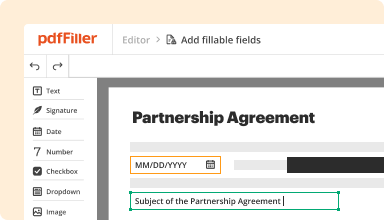

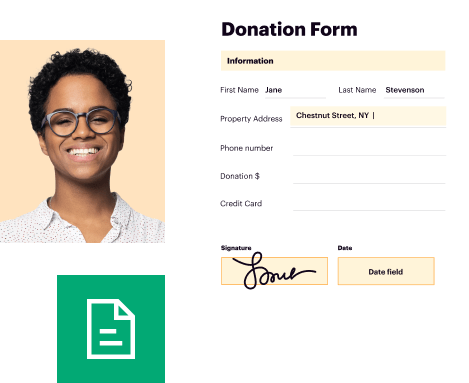

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

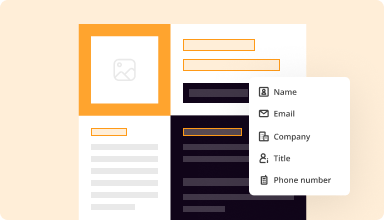

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

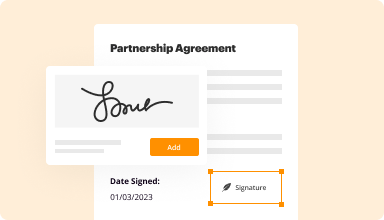

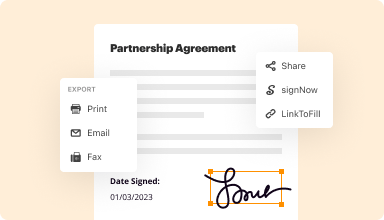

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

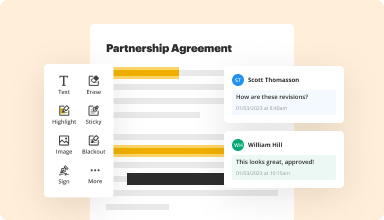

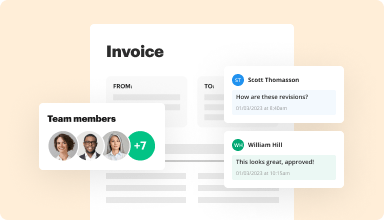

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

Customize Your Payroll Deduction Authorization Template

Enhance your payroll process with our customizable Payroll Deduction Authorization template. This tool allows you to create an authorization form that meets your organization's specific needs. You can streamline your employee payroll deductions accurately and efficiently.

Key Features

Fully customizable sections to fit your organization

User-friendly interface for easy setup

Secure storage for employee information

Built-in compliance checks to meet legal standards

Seamless integration with payroll systems

Potential Use Cases and Benefits

Perfect for businesses looking to simplify payroll deductions

Ideal for organizations that require specific deduction types

Reduces paperwork and manual errors

Enhances employee satisfaction by providing clear deduction processes

Saves time during payroll processing

This template solves your payroll challenges by providing a clear, organized method for managing deductions. It helps you avoid confusion and ensures compliance with regulations. As a result, you not only improve your payroll accuracy but also enhance trust among your employees.

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to build a Payroll Deduction Authorization

Creating a Payroll Deduction Authorization has never been easier with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller offers an instinctive platform to make, customize, and handle your documents effectively. Utilize our versatile and editable web templates that align with your specific needs.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to smoothly create accurate documents with a simple click. Begin your journey by following our detailed instructions.

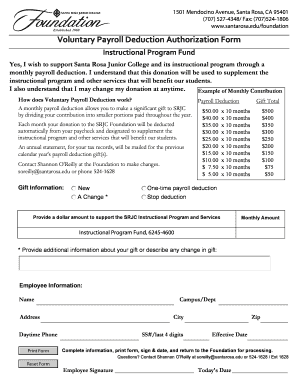

How to create and complete your Payroll Deduction Authorization:

01

Sign in to your account. Access pdfFiller by signing in to your profile.

02

Find your template. Browse our complete collection of document templates.

03

Open the PDF editor. Once you have the form you need, open it up in the editor and use the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can select from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Include text, highlight information, insert images, and make any required adjustments. The intuitive interface ensures the procedure remains smooth.

06

Save your changes. When you are happy with your edits, click the “Done” button to save them.

07

Send or store your document. You can send out it to others to eSign, download, or securely store it in the cloud.

To summarize, creating your documents with pdfFiller templates is a straightforward process that saves you time and ensures accuracy. Start using pdfFiller today to make the most of its powerful features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

What is a payroll deduction authorization?

A payroll deduction plan is voluntary when an employee authorizes an employer in writing to withhold money for certain benefits or services, such as a retirement savings plan, healthcare, or life insurance premiums, among others.

Do payroll deductions have to be approved by the employee in writing?

Labor Code Section 224 clearly prohibits any deduction from an employee's wages which is not either authorized by the employee in writing or permitted by law, and any employer who resorts to self-help does so at its own risk as an objective test is applied to determine whether the loss was due to dishonesty,

What is a deduction agreement?

Salary Deduction Agreement means an agreement pursuant to which an Employee agrees to have an amount deducted from his Eligible Earnings, on an after-tax basis, and the County agrees to contribute to the Plan the amount deducted as an After-Tax Contribution.

Which of the following is an example of a payroll deduction?

Specific examples of each type of payroll deduction include: Pre-tax deductions: Medical and dental benefits, 401(k) retirement plans (for federal and most state income taxes) and group-term life insurance. Mandatory deductions: Federal and state income tax, FICA taxes, and wage garnishments.

What does payroll deduction mean?

Subscribe now. Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax.

What is an example of a wage deduction authorization agreement?

I authorize [company name] to withhold from my wages the total amount of $ [amount] which shall be withheld at a rate of $ [amount] per pay period for [number] of pay periods for the purpose of [explain the reason for withholding].

What is a wage agreement deduction?

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

Can an employer write off payroll taxes?

Yes, employer payroll taxes are a business expense that you can deduct on your business taxes. Employee wages are also a business tax write-off. Employee wages include employee payroll taxes, so your business deducts everything you pay your employees, including the portion that goes toward employee payroll taxes.

How do you explain payroll deductions to employees?

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax.

Who is responsible for payroll deductions?

Employers generally must withhold social security and Medicare taxes from employees' wages and pay the employer share of these taxes. Social security and Medicare taxes have different rates and only the social security tax has a wage base limit.

Are payroll deductions good?

While you may not want to lose any of your take-home pay, payroll deductions can be a smart way to lower your taxes and help you save money for retirement.

Is the payroll deduction the same as direct deposit?

Direct Deposit may be set up for recurring payments, such as your paycheck or social security check or one-time payments such as your tax refund or expense reimbursement. Payroll Deduction is the term used when only a portion of your paycheck is deposited automatically.

Is payroll deduction pre-tax?

Pre-tax deductions and other payroll deductions both allocate a portion of an employee's paycheck for specific purposes. This reduces their net pay (take-home pay). All pre-tax deductions are payroll deductions, but not all payroll deductions are withheld on a pre-tax basis.

What does payroll deducted mean?

Payroll deductions are wages withheld from an employee's paycheck for the payment of taxes, benefits, or garnishments. There are both mandatory and voluntary payroll deductions. The order in which deductions are taken out of paychecks also matters because some are made pre-tax and some are made post-tax.