Last updated on

Sep 20, 2025

Customize and complete your essential Life Insurance Quote Form template

Prepare to streamline document creation using our fillable Life Insurance Quote Form template. Create exceptional documents effortlessly with just a few clicks.

Spend less time on PDF documents and forms with pdfFiller’s tools

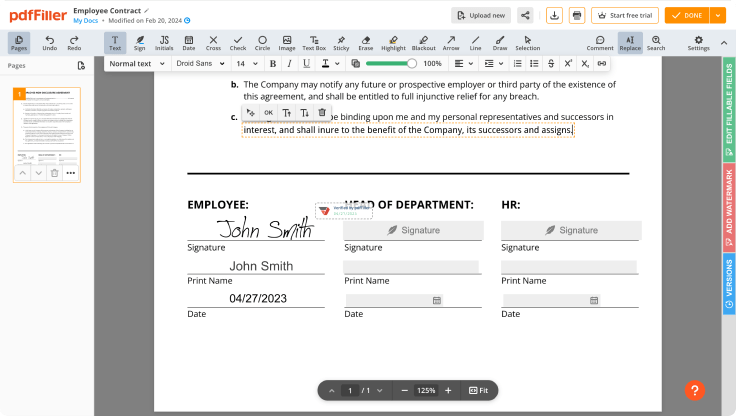

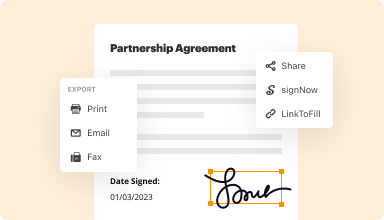

Comprehensive PDF editing

Build documents by adding text, images, watermarks, and other elements. A complete set of formatting tools will ensure a polished look of your PDFs.

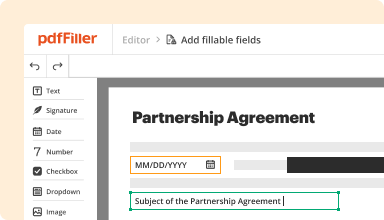

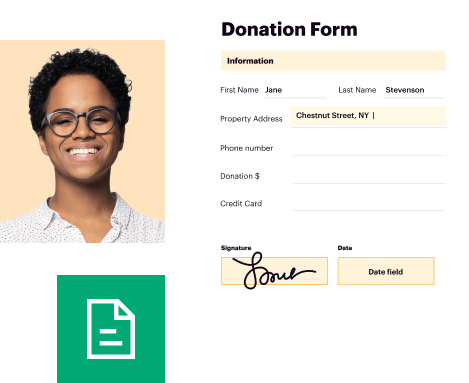

Fillable fields

Drag and drop fillable fields, checkboxes, and dropdowns on your PDFs, allowing users to add their data and signatures without hassle.

Templates for every use case

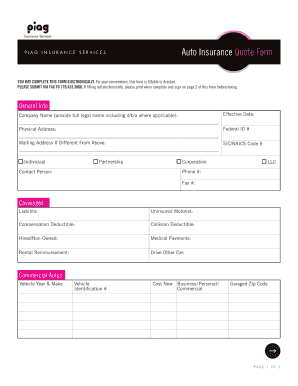

Speed up creating contracts, application forms, letters, resumes, and other documents by selecting a template and customizing it to your needs.

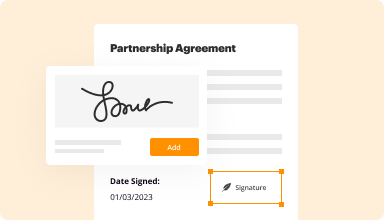

Electronic signature

Instantly sign any document and make it easy for others to sign your forms by adding signature fields, assigning roles, and setting a signing order.

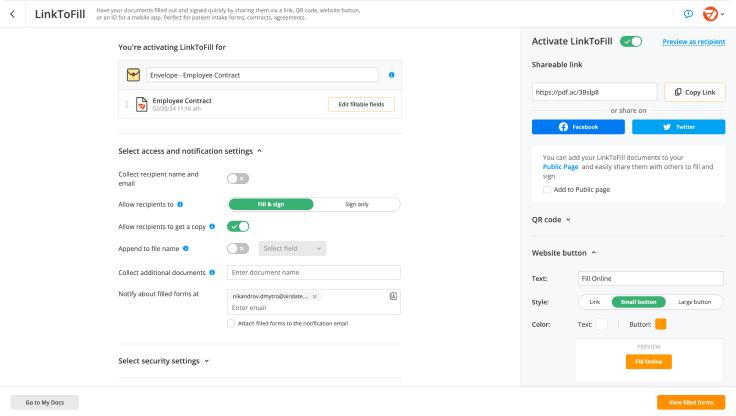

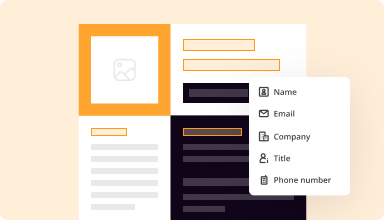

Online forms

Publish fillable forms on your website or share them via a direct link to capture data, collect signatures, and request payments.

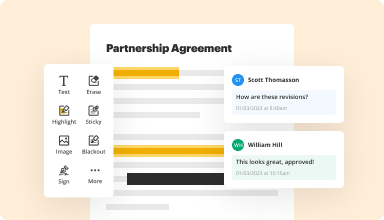

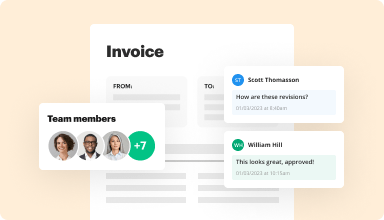

Easy collaboration

Work on documents together with your teammates. Exchange comments right inside the editor, leave sticky notes for your colleagues, highlight important information, and blackout sensitive details.

Millions of users trust pdfFiller to create, edit, and manage documents

64M+

million users worldwide

35M+

PDF forms available in the online library

53%

of documents created from templates

65.5K+

documents added daily

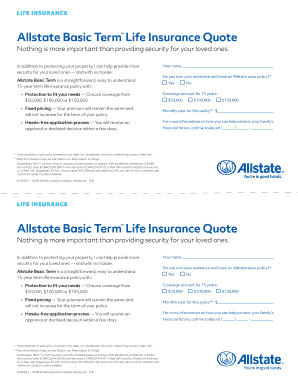

Customize Your Life Insurance Quote Form Template

Create a tailored Life Insurance Quote Form that meets your needs today. With our template feature, you can easily customize every aspect to reflect your specific requirements. This ensures that the information you gather is relevant and beneficial for your clients.

Key Features

User-friendly interface for easy customization

Multiple fields for detailed client information

Responsive design for seamless access on any device

Secure data collection and storage

Customizable branding options to match your business

Potential Use Cases and Benefits

Streamline the process of collecting client information

Enhance customer experience with personalized forms

Improve data accuracy and reduce errors in information gathering

Facilitate faster quote generation

Increase client trust with a professional-looking form

By using our customizable Life Insurance Quote Form template, you address a common issue: the need for accurate and tailored information. Instead of relying on generic forms, you can gather specific details that help you create personalized insurance solutions. This not only saves time but also enhances the customer experience, leading to better client relationships.

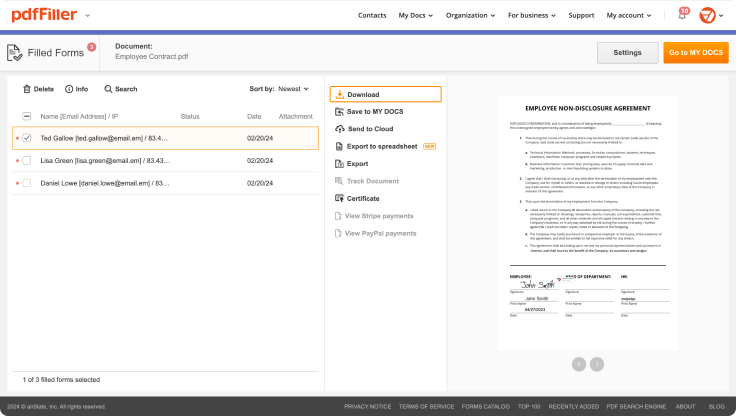

Kickstart your document creation process

Browse a vast online library of documents and forms for any use case and industry.

Top-rated PDF software recognized for its ease of use, powerful features, and impeccable support

Our user reviews speak for themselves

Your go-to guide on how to create a Life Insurance Quote Form

Creating a Life Insurance Quote Form has never been simpler with pdfFiller. Whether you need a professional forms for business or personal use, pdfFiller provides an instinctive solution to generate, customize, and handle your documents efficiently. Employ our versatile and fillable web templates that align with your specific demands.

Bid farewell to the hassle of formatting and manual editing. Employ pdfFiller to smoothly create polished documents with a simple click. your journey by following our detailed instructions.

How to create and complete your Life Insurance Quote Form:

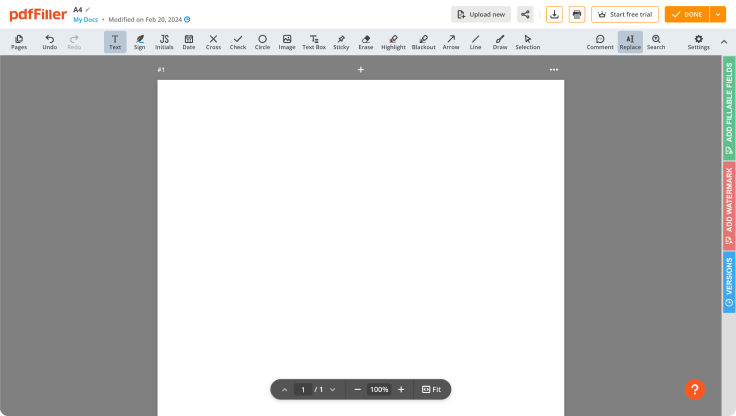

01

Create your account. Access pdfFiller by logging in to your account.

02

Find your template. Browse our comprehensive library of document templates.

03

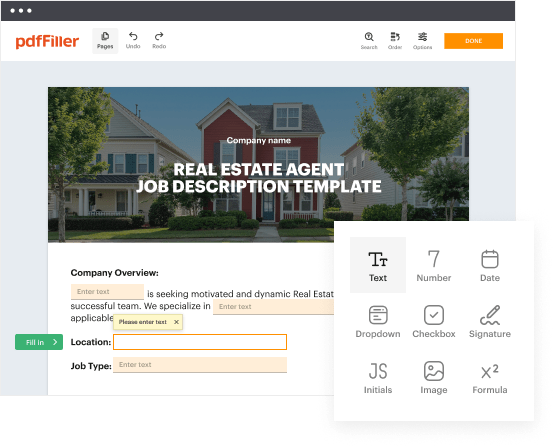

Open the PDF editor. When you have the form you need, open it in the editor and use the editing instruments at the top of the screen or on the left-hand sidebar.

04

Place fillable fields. You can pick from a list of fillable fields (Text, Date, Signature, Formula, Dropdown, etc.).

05

Adjust your form. Include text, highlight information, insert images, and make any necessary adjustments. The user-friendly interface ensures the procedure remains easy.

06

Save your edits. Once you are satisfied with your edits, click the “Done” button to save them.

07

Submit or store your document. You can deliver it to others to eSign, download, or securely store it in the cloud.

In conclusion, crafting your documents with pdfFiller templates is a smooth process that saves you efforts and ensures accuracy. Start using pdfFiller today to take advantage of its powerful features and seamless paperwork management.

Ready to try the award-winning PDF editor in action?

Start creating your document in pdfFiller and experience firsthand how effortless it can be.

Questions & answers

Below is a list of the most common customer questions.If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What if I have more questions?

Contact Support

How do insurance quotes work?

A quote is an estimate of premium for the insurance coverage you selected and information you entered. A quote is not an offer for insurance or an insurance contract. Farmers offers online insurance quotes for auto insurance, home insurance, renters insurance, condo insurance and term life insurance.

Can I set up life insurance online?

Yes, the process of buying life insurance has never been easier now it's possible to apply for and purchase a policy online. Obtain multiple quotes, apply and buy life insurance online. With just a few clicks of a button you could find your perfect policy.

Why is a quote important in insurance?

Asking for insurance quotes is a risk-free way to compare various insurers and the policies they offer without having to pay or make a commitment. To compare the quotes effectively, buyers must provide the same information for all quotes, even if the broker or agent does not ask for it.

What is the difference between an insurance estimate and a quote?

From this, the company generates an estimate for your premium. That estimate is your insurance quote. Your quote tells you approximately what it costs for you to get a policy with that particular insurance company. Most companies send insurance quotes that include details about the policy you hope to buy.

What are quotes used for insurance?

An insurance quote is the estimated cost of a policy based on the information you provide to the insurer and the coverage you select. You typically receive an insurance quote when you're shopping around for new coverage.

What are quotes for insurance?

An insurance quote is the estimated cost of a policy based on the information you provide to the insurer and the coverage you select. You typically receive an insurance quote when you're shopping around for new coverage.

How many quotes do I need for insurance?

We recommend comparing at least five insurance quotes before making a decision. However, before you pick the policy with the lowest premium rate, there are several other factors you need to consider.

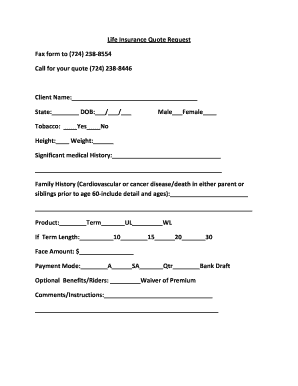

What information is needed for a life insurance quote?

Documents needed for life insurance If you first seek an insurance quote online, you may only have to give a few pieces of information, such as your age, weight, height, gender, and a few facts about your lifestyle and medical history, like previous surgeries and whether or not you smoke.

How much does a $1,000,000 life insurance policy cost per month?

Average cost of a million-dollar term life insurance policy AgeTerm lengthAverage monthly rate 30 Term length30 years Average monthly rate$86.57 40 Term length10 years Average monthly rate$47.41 40 Term length15 years Average monthly rate$61.33 40 Term length30 years Average monthly rate$137.895 more rows

Is it okay to buy life insurance online?

Since many factors determine your coverage needs, online insurers may not offer the most suitable coverage. Many online insurers may only offer policies that would suit the average person. Additionally, online insurers don't have an intuitive nature that can identify the most suitable policy to match your risks.

How much is $100,000 in life insurance a month?

A $100,000 whole life insurance policy generally costs between $150 to $200 per month. This premium is higher than that for term life insurance due to the lifelong coverage and the policy's cash value component.

Can I order life insurance online?

With instant life insurance, you can apply for a policy online and often get a decision and price within minutes. Instead of relying on medical exams, insurers use sophisticated data models to assess your application and set rates.