Free Promissory Note Agreement Word Templates - Page 3

What are Promissory Note Agreement Templates?

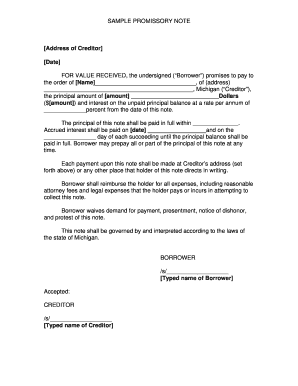

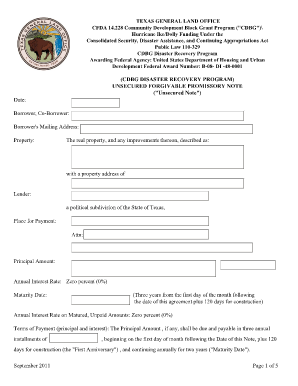

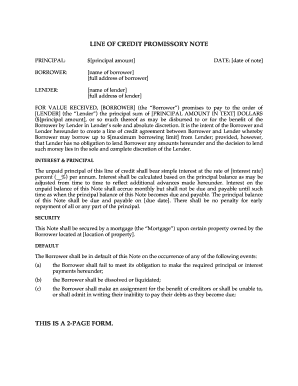

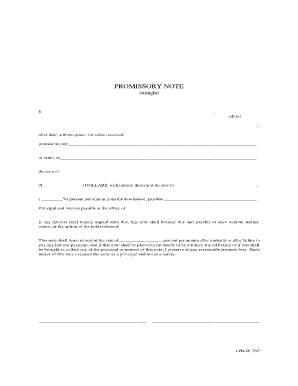

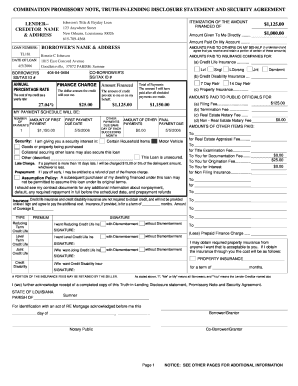

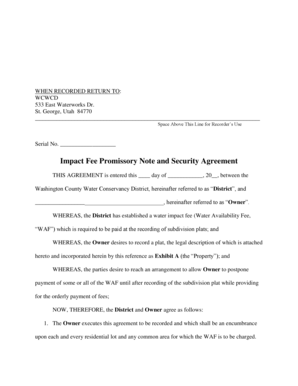

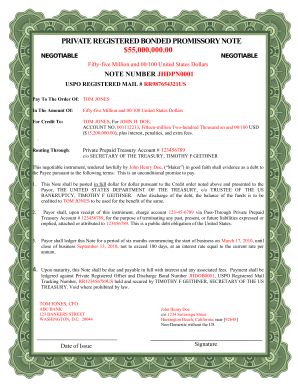

Promissory Note Agreement Templates are legal documents that outline the terms and conditions of a loan agreement between a lender and a borrower. These templates typically include details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. Using a template can help both parties ensure that they are on the same page and prevent misunderstandings down the line.

What are the types of Promissory Note Agreement Templates?

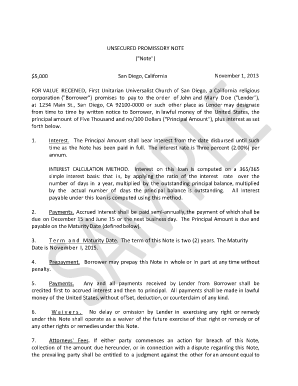

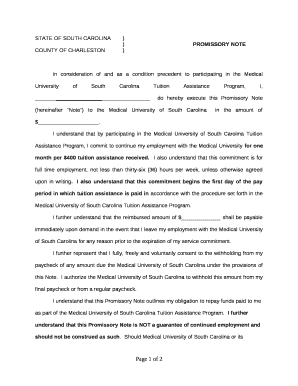

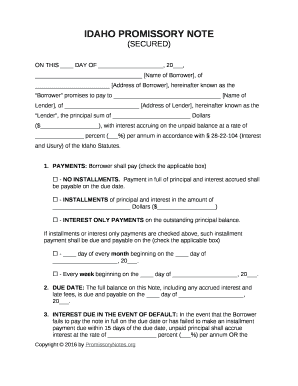

There are several types of Promissory Note Agreement Templates, each designed for specific loan situations. Some common types include: 1. Secured Promissory Note: This type of note is backed by collateral, such as a car or house, which the lender can seize if the borrower defaults on the loan. 2. Unsecured Promissory Note: This type of note does not require any collateral and is based solely on the borrower's promise to repay the loan. 3. Demand Promissory Note: This type of note allows the lender to request repayment of the loan at any time, rather than following a set repayment schedule.

How to complete Promissory Note Agreement Templates

Completing a Promissory Note Agreement Template is a straightforward process that can be done by following these steps: 1. Fill in the borrower and lender information, including names, addresses, and contact details. 2. Specify the loan amount, interest rate, and repayment terms in the appropriate sections of the template. 3. Include any additional terms or conditions that both parties agree to, such as late payment penalties or prepayment options. 4. Review the completed template carefully to ensure all details are accurate and comprehensive. 5. Sign and date the document to make it legally binding for both parties.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.