Free Payroll Services Word Templates - Page 37

What are Payroll Services Templates?

Payroll Services Templates are pre-designed forms or documents that businesses use to manage their payroll processes. These templates typically include fields for employee information, wages, taxes, deductions, and other payroll-related details.

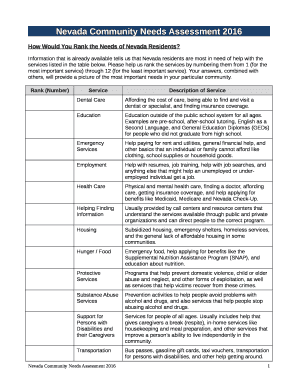

What are the types of Payroll Services Templates?

There are several types of Payroll Services Templates available to businesses, including:

Employee Information Template

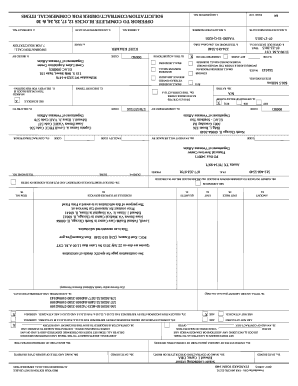

Pay Stub Template

Wage and Hour Template

Tax Deduction Template

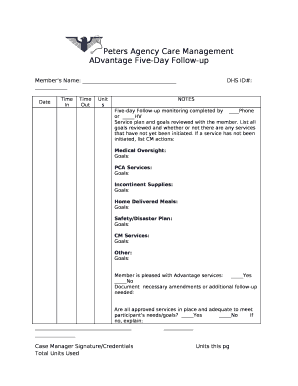

Benefits Template

How to complete Payroll Services Templates

Completing Payroll Services Templates is easy and efficient when using the right tools. Follow these steps to complete your Payroll Services Templates:

01

Gather all necessary information, including employee details, wages, taxes, and deductions.

02

Input the information into the designated fields on the template.

03

Review the completed document for accuracy and compliance with regulations.

04

Save and share the finalized template with your team or payroll provider.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Payroll Services Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much does a payroll service cost?

QuickBooks Payroll is a cloud-based payroll software that allows businesses to pay employees, file payroll taxes and manage employee benefits and HR in one place. The software saves time by automatically calculating, filing and paying federal and state payroll taxes.

What is the best payroll company?

Our payroll pricing is categorized into 3 plans. Our basic program specially designed for small businesses in India cost is ₹25 per employee per month. Our other 2 plans (Premium: ₹39 /Month /Employee) and (Ultimate: ₹49 /Month /Employee) are designed for medium and large-size businesses in India.

What is a payroll service?

Yes. All QuickBooks Online Payroll plans offer full-service payroll. That means, in addition to automated payroll, you'll receive full-service features. Automated taxes and forms: Federal and state payroll taxes—including your year-end filings—are calculated, filed, and paid automatically.

What is payroll services in Canada?

A payroll service provider is a company that automatically processes payroll calculations, remits the resulting statutory amounts, produce year-end employee tax forms and files them electronically with the Canada Revenue Agency (CRA) and Revenue Quebec (RQ) for any Quebec employees, produces Records of Employment (ROE)

How do payroll services make money?

Charging fees per pay frequency is the most common way payroll companies charge for their services. That means however often you pay employees (weekly, bi-weekly, semi-monthly or monthly), you'll be charged for the number of employees you pay each pay period.

What is a payroll example?

A document that details the employee's gross wages, taxes, and deductions. employer contributions and taxes. and the employee's net pay. Forms employers must file with tax agencies (e.g., the IRS) that summarize employee pay information, such as wages and taxes. Examples include Form 941 and Form W-2.