Free Budget Calendar Word Templates

What are Budget Calendar Templates?

Budget calendar templates are tools that help individuals and businesses plan and track their finances over a specific period. These templates typically include sections for income, expenses, and savings goals, allowing users to visualize their financial situation and make informed decisions.

What are the types of Budget Calendar Templates?

There are several types of budget calendar templates available, including:

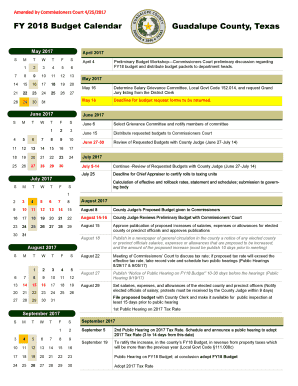

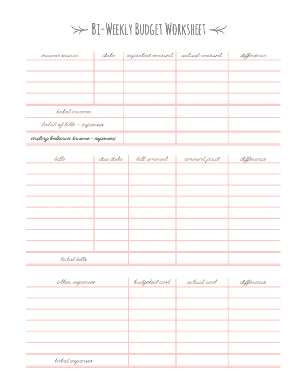

Monthly budget calendar templates

Weekly budget calendar templates

Yearly budget calendar templates

How to complete Budget Calendar Templates

Completing budget calendar templates is easy and can help you stay organized with your finances. Here are some steps to follow:

01

Gather all your financial information such as income sources, expenses, and savings goals

02

Fill in the appropriate sections of the budget calendar template with the corresponding information

03

Regularly update your budget calendar with any changes to your finances

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Budget Calendar Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is there a free budget app?

Budgeting resources from NerdWallet The free NerdWallet app lets you track your cash flow, including how your spending fits into the 50/30/20 budget guidelines. You can also see your net worth and debt, and monitor your credit score.

How do I create a free monthly budget?

Best free budgeting tools Best free spreadsheet for anyone: Google Sheets. Best overall free smartphone app: Mint. Best free smartphone app for beginners: Goodbudget. Best free smartphone app for investors: Personal Capital. Best free desktop software for small business owners: GnuCash.

How do I create a monthly budget list?

Creating a budget Step 1: Calculate your net income. The foundation of an effective budget is your net income. Step 2: Track your spending. Step 3: Set realistic goals. Step 4: Make a plan. Step 5: Adjust your spending to stay on budget. Step 6: Review your budget regularly.

What should a monthly budget look like?

You should set your budget percentages in a way that works best for you. The popular 50/30/20 rule of budgeting advises people to save 20% of their income every month. That leaves 50% for needs, including essentials like mortgage or rent and food. The remaining 30% of your income is for discretionary spending.

How do I create a budget calendar?

List your paydays for the month. Write down all your pay dates on your budget calendar template. List your monthly bills and their due dates. Whenever a bill is due, write it down on your budget calendar. Add your savings contributions. Add any special occasions or holidays. Color code your income and bills.

How do I make a list of monthly expenses?

20 Common Monthly Expenses to Include in Your Budget Housing or Rent. Housing and rental costs will vary significantly depending on where you live. Transportation and Car Insurance. Travel Expenses. Food and Groceries. Utility Bills. Cell Phone. Childcare and School Costs. Pet Food and Care.