Free Accounting Checklist Word Templates - Page 5

What are Accounting Checklist Templates?

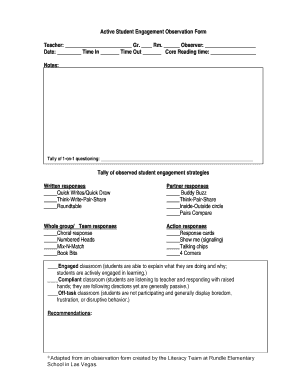

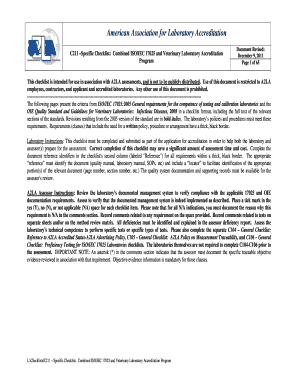

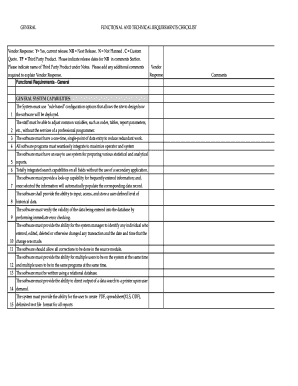

Accounting Checklist Templates are tools used to help individuals and businesses organize and track their financial information. These templates typically include a list of items that need to be checked off or completed to ensure accurate accounting records.

What are the types of Accounting Checklist Templates?

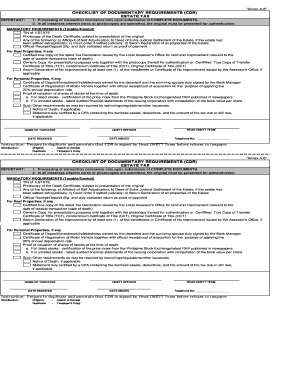

There are various types of Accounting Checklist Templates available, including: Income Statement Checklist, Balance Sheet Checklist, Cash Flow Statement Checklist, Budget Checklist, Payroll Checklist, Tax Checklist, Audit Checklist, and General Ledger Checklist.

How to complete Accounting Checklist Templates

To complete Accounting Checklist Templates effectively, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.