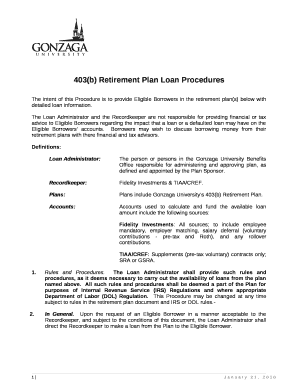

Free Tax Preparation And Planning Word Templates - Page 9

What are Tax Preparation And Planning Templates?

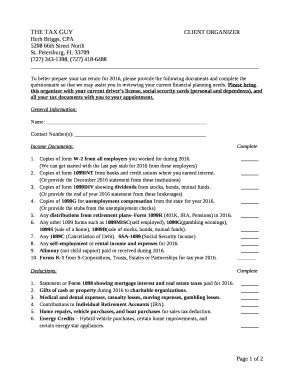

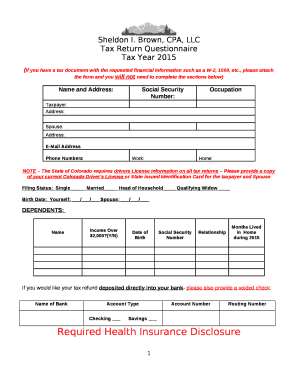

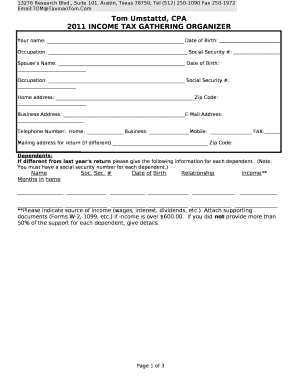

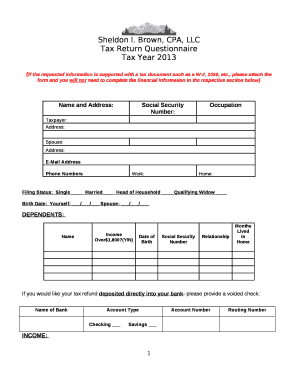

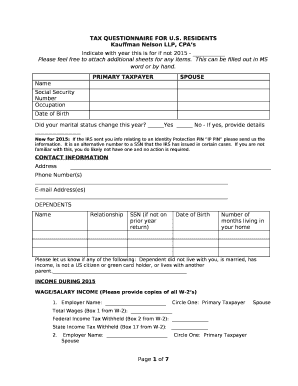

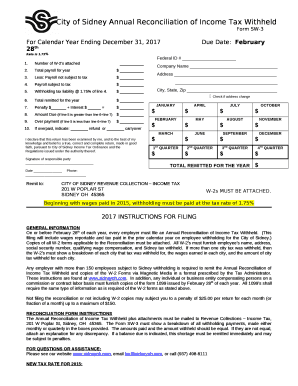

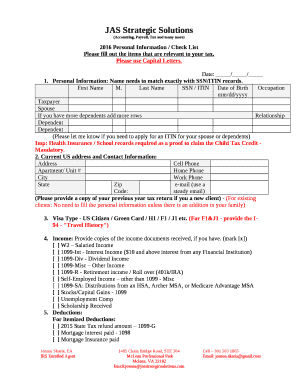

Tax preparation and planning templates are pre-designed forms or documents that individuals or businesses can use to organize and file their taxes. These templates help streamline the process of gathering and organizing important financial information to ensure accurate and timely tax filings.

What are the types of Tax Preparation And Planning Templates?

There are several types of tax preparation and planning templates available, including:

Income tax return templates

Expense tracking templates

Income statement templates

Tax deduction templates

How to complete Tax Preparation And Planning Templates

Completing tax preparation and planning templates is essential for accurate tax filing. Here are some steps to help you complete these templates effectively:

01

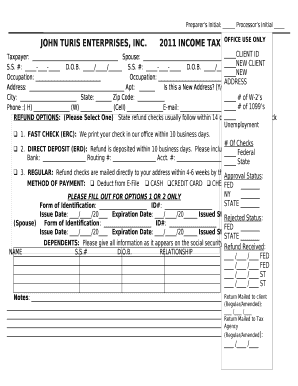

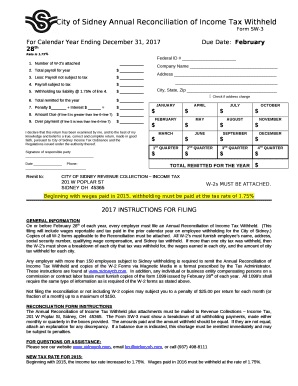

Gather all necessary financial documents, including W-2s, 1099s, receipts, and other supporting documents.

02

Fill in personal information accurately, including name, address, and social security number.

03

Organize income and expenses into the appropriate sections of the template.

04

Double-check all information for accuracy and completeness before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Tax Preparation And Planning Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 3 basic tax planning strategies?

There are a number of ways you can go about tax planning, but it primarily involves three basic methods: reducing your overall income, increasing your number of tax deductions throughout the year, and taking advantage of certain tax credits.

What is the difference between an accountant and a tax planner?

Accountants do auditing work, financial forecasting, and putting together financial statements, while financial planners help individuals with wealth management and retirement planning. Accountants are usually detail-oriented and good with numbers, while financial planners are better at sales and networking.

How do I prepare for tax planning?

Here are some key tax planning and tax strategy concepts to understand before you make your next money move. Tax planning starts with understanding your tax bracket. The difference between tax deductions and tax credits. Taking the standard deduction vs. Keep an eye on popular tax deductions and credits.

What is tax planning done to do?

Usually, tax planning consists in maintaining the taxpayer in a certain tax bracket in order to reduce the amount of taxes to be paid, which can be done by manipulating the timing of income, purchases, selecting retirement plans, and investing ingly.

What do you do in tax planning?

Tax planning covers several considerations. Considerations include timing of income, size, and timing of purchases, and planning for other expenditures. Also, the selection of investments and types of retirement plans must complement the tax filing status and deductions to create the best possible outcome.

Why do people do tax planning?

Proper tax planning makes it easier to build your personal finances and afford the things you want. Additionally, by anticipating taxes when you create your financial plan, it's possible to significantly boost how much money you will have in retirement.