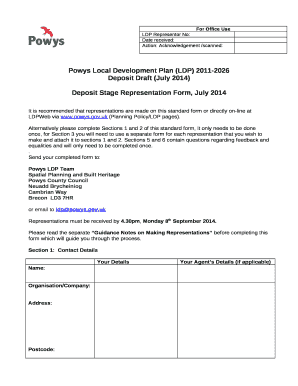

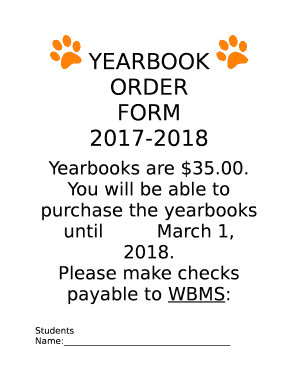

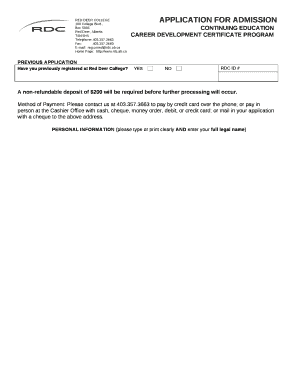

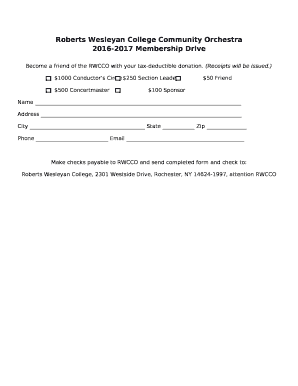

Free Checks Word Templates - Page 99

What are Checks Templates?

Checks Templates are pre-designed formats that allow users to easily fill in personal or business information on checks. These templates streamline the process of writing checks by providing a structured layout for important details such as payee name, amount, and date.

What are the types of Checks Templates?

There are several types of Checks Templates available, including: blank check templates, payroll check templates, business check templates, personal check templates, and voucher check templates.

How to complete Checks Templates

Completing Checks Templates is a simple process that involves filling in the necessary information in the designated fields. Here are the steps to complete a Checks Template:

By using pdfFiller, users can easily create, edit, and share Checks Templates online. With unlimited fillable templates and powerful editing tools, pdfFiller is the ultimate solution for getting your checks done efficiently and accurately.