Free Funds Word Templates - Page 175

What are Funds Templates?

Funds Templates are pre-designed documents or spreadsheets that help individuals or businesses track their financial activities and manage their funds more effectively. These templates typically include sections for income, expenses, budgeting, savings, investments, and other related information.

What are the types of Funds Templates?

There are several types of Funds Templates available, including:

Income and Expense Tracker

Budget Planner

Savings Goal Worksheet

Investment Portfolio Tracker

Financial Statement Template

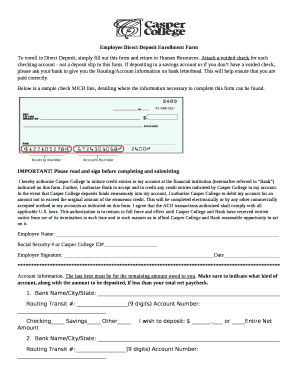

How to complete Funds Templates

Completing Funds Templates is a simple process that can help you stay organized and in control of your finances. Here are some steps to follow:

01

Gather all your financial documents and information

02

Enter your income and expenses accurately

03

Set realistic budget goals and track your spending

04

Update the template regularly to reflect any changes in your financial situation

05

Review and analyze the data to make informed financial decisions

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done

Video Tutorial How to Fill Out Funds Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What Is the Purpose of a Fund?

Types of Mutual Funds Equity funds. Debt funds. Money market funds. Index funds. Balanced funds. Income funds. Fund of funds. Specialty funds. 8 Mutual Fund Types - How to Choose the right Mutual Fund? - BankBazaar bankbazaar.com https://.bankbazaar.com › mutual-fund › types-of- bankbazaar.com https://.bankbazaar.com › mutual-fund › types-of-

Is funds the same as money?

A fund refers to an amount of money kept aside for financial goals such as buying an asset, planning for retirement, or tiding over an emergency. Think of it as an amount you keep aside or invest for your next vacation, a new phone, or even a luxury handbag.

What do you mean by the term funds?

A fund is a type of investment that collects money from many people. The money is subsequently used by fund managers to invest in a variety of stocks and bonds. Each investor is given units that represent a percentage of the fund's holdings. How do mutual funds work?

What is a fund of funds in finance?

A fund of funds (FOF)—also known as a multi-manager investment—is a pooled investment fund that invests in other types of funds. In other words, its portfolio contains different underlying portfolios of other funds. These holdings replace any investing directly in bonds, stocks, and other types of securities.

What are 3 types of funds?

There are three major types of funds. These types are governmental, proprietary, and fiduciary.