Free Hedge Fund Word Templates

What are Hedge Fund Templates?

Hedge Fund Templates are pre-designed documents that outline the structure and operations of a hedge fund. These templates serve as a starting point for fund managers to create legal, financial, and operational documents necessary for running a hedge fund.

What are the types of Hedge Fund Templates?

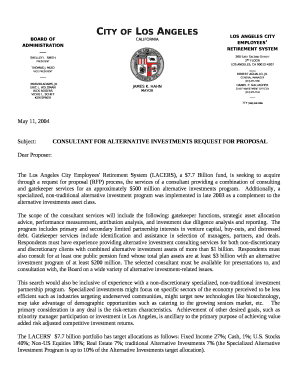

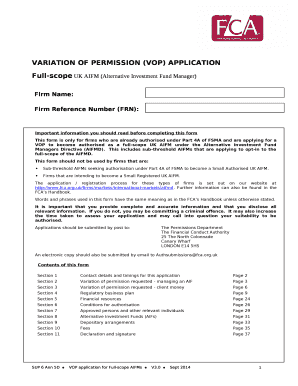

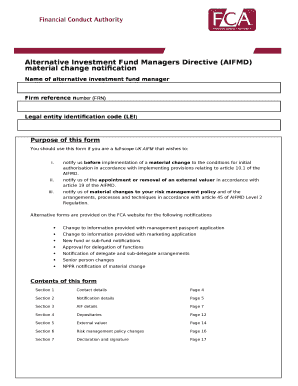

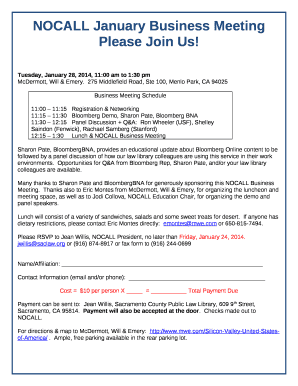

There are various types of Hedge Fund Templates available to fund managers. Some common types include:

How to complete Hedge Fund Templates

Completing Hedge Fund Templates is a crucial step in launching and managing a successful hedge fund. Here are some tips on how to complete Hedge Fund Templates effectively:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. With pdfFiller, fund managers can efficiently complete Hedge Fund Templates and streamline their document management processes.