Free Mutual Funds Word Templates - Page 23

What are Mutual Funds Templates?

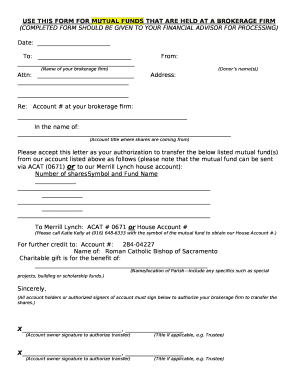

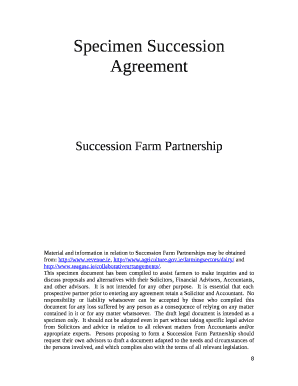

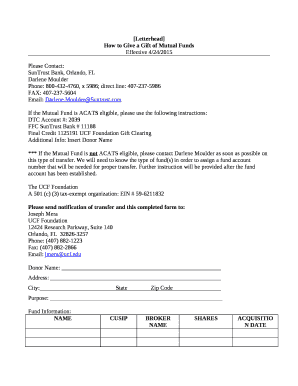

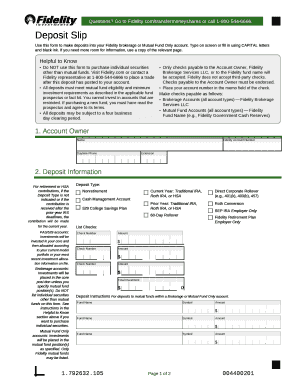

Mutual Funds Templates are pre-designed financial document layouts that aid in organizing and presenting mutual fund-related information. These templates are specifically tailored to meet the needs of investors, financial advisors, and institutions dealing with mutual funds.

What are the types of Mutual Funds Templates?

There are various types of Mutual Funds Templates available to cater to different aspects of mutual fund investment. Some common types include: 1. Mutual Fund Fact Sheet Template 2. Mutual Fund Performance Report Template 3. Mutual Fund Investment Proposal Template 4. Mutual Fund Portfolio Analysis Template

How to complete Mutual Funds Templates

Completing Mutual Funds Templates is essential for accurate tracking and analysis of mutual fund investments. Here are the steps to effectively complete Mutual Funds Templates:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.