Free Futures Trading Word Templates

What are Futures Trading Templates?

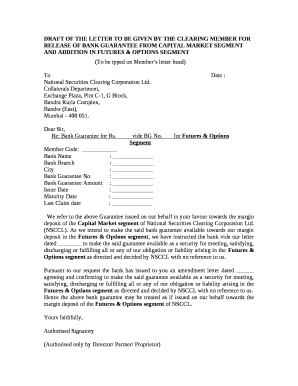

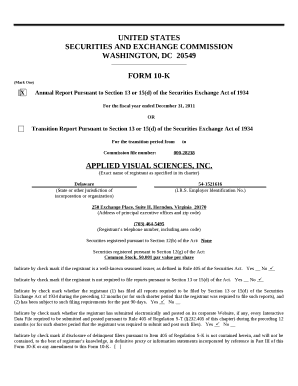

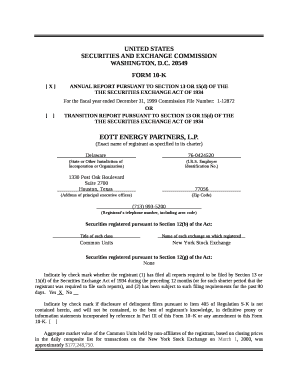

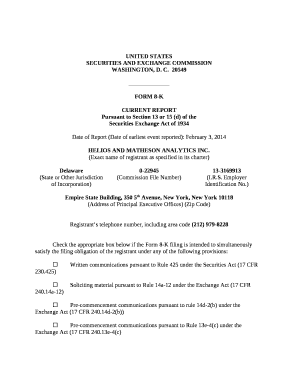

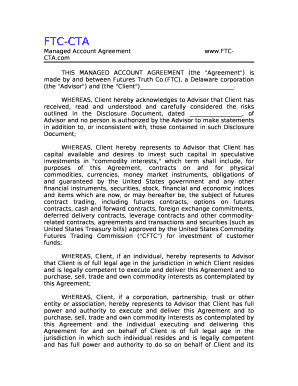

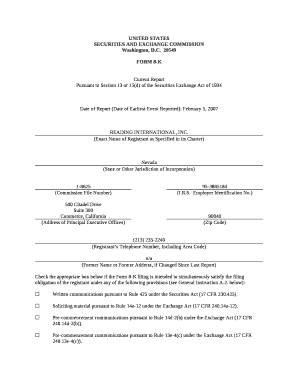

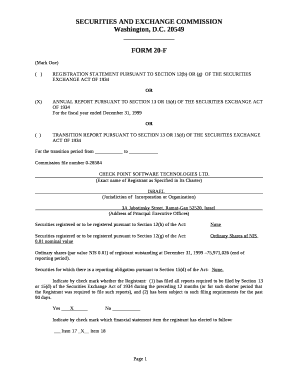

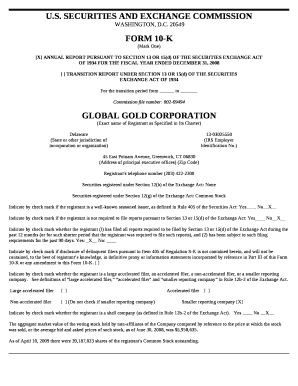

Futures trading templates are pre-designed documents that help traders outline their strategies, analyze market trends, and make informed decisions when trading futures contracts. These templates can save time and provide a structured approach to trading in the financial markets.

What are the types of Futures Trading Templates?

There are several types of futures trading templates available to traders, including:

How to complete Futures Trading Templates

Completing futures trading templates can be a valuable exercise in organizing your trading strategy and staying disciplined. Here are some steps to help you complete futures trading templates effectively:

pdfFiller is a powerful online tool that empowers users to create, edit, and share futures trading templates. With unlimited fillable templates and robust editing tools, pdfFiller is the go-to PDF editor for traders looking to streamline their document workflows and enhance their trading performance.