Free Venture Capital Word Templates

What are Venture Capital Templates?

Venture Capital Templates are pre-designed documents that outline the terms and conditions of a venture capital investment. These templates help streamline and standardize the investment process, making it easier for both parties involved.

What are the types of Venture Capital Templates?

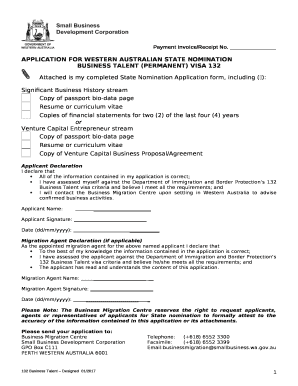

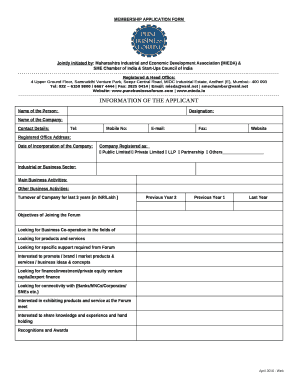

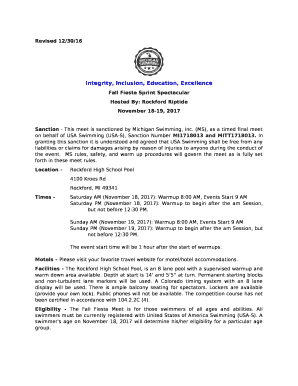

There are several types of Venture Capital Templates available to cater to different investment scenarios. Some common types include:

How to complete Venture Capital Templates

Completing Venture Capital Templates is a simple process that involves filling in the necessary information and ensuring all terms are agreed upon by both parties. Here are some steps to help you complete Venture Capital Templates:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.