Free Cash Receipt Word Templates

What are Cash Receipt Templates?

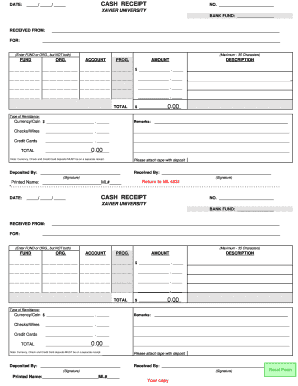

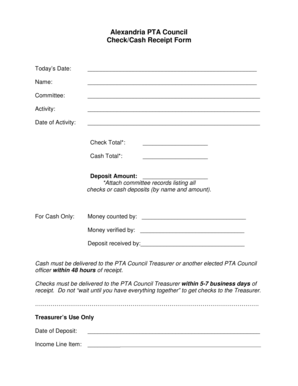

Cash receipt templates are pre-designed forms that allow individuals and businesses to easily create professional receipts for financial transactions. These templates typically include fields for the date, amount received, payment method, and other relevant information.

What are the types of Cash Receipt Templates?

There are several types of cash receipt templates available, each tailored to specific needs. Some common types include:

Basic Cash Receipt Template

Donation Receipt Template

Rent Receipt Template

Petty Cash Receipt Template

Sales Receipt Template

How to complete Cash Receipt Templates

Completing cash receipt templates is easy and straightforward. Simply follow these steps:

01

Fill in the recipient's name and contact information

02

Enter the date of the transaction

03

Describe the reason for the payment

04

Specify the amount received

05

Include any additional details, such as payment method or invoice number

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Cash Receipt Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is a cash receipt legal?

Because you have already received the cash at the point of sale, you can record it in your books. Again, you must record a debit in your cash receipts journal and a credit in your sales journal. Record a $250 debit in your cash receipts journal and a $250 credit in your sales journal.

What are the 5 sources of cash receipt?

What are the major sources of cash receipt in a business? It includes investment of capital by the proprietor or owner, cash sales, sale of an asset for cash, collection from customers, collection of interest, dividends, or rent and loan from an individual, bank, or any other financial institution.

What is not considered as cash receipt?

In accounting, a non-cash item refers to an expense listed on an income statement, such as capital depreciation, investment gains, or losses, that does not involve a cash payment.

How do I make a cash receipt?

How to Process Cash Receipts Record Checks and Cash. When the daily mail delivery arrives, record all received checks and cash on the mailroom check receipts list. Forward Payments. Apply Cash to Invoices. Record Other Cash (Optional) Deposit Cash. Match to Bank Receipt.

What are examples of cash receipts?

Cash Received from Customers = Sales + Decrease (or - Increase) in Accounts Receivable. Cash Paid for Operating Expenses (Includes Research and Development) = Operating Expenses + Increase (or - decrease) in prepaid expenses + decrease (or - increase) in accrued liabilities.