Free Personal Finance Word Templates - Page 8

What are Personal Finance Templates?

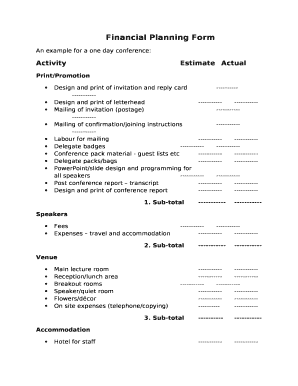

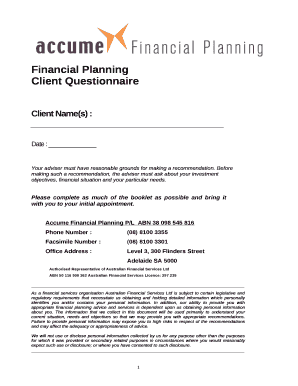

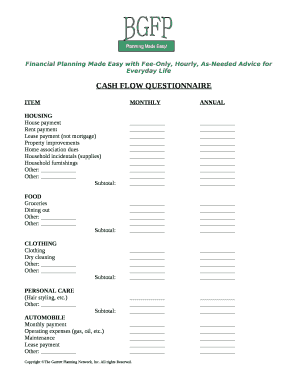

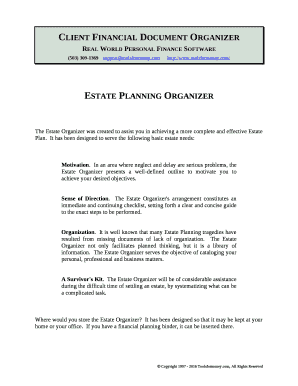

Personal Finance Templates are pre-designed spreadsheets or documents that help individuals organize their financial information. These templates cover various aspects of personal finance, such as budgeting, expense tracking, investment planning, and debt management.

What are the types of Personal Finance Templates?

There are several types of Personal Finance Templates available to suit different financial needs. Some common types include:

How to complete Personal Finance Templates

Completing Personal Finance Templates is easy and can provide valuable insights into your financial health. Here are some steps to help you fill out these templates:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.