What are Saving Templates?

Saving templates are pre-designed documents that can be used as a base for creating new files. These templates help users save time and effort by providing a starting point for their projects.

What are the types of Saving Templates?

There are several types of saving templates available to users, including:

Business Proposal Templates

Resume Templates

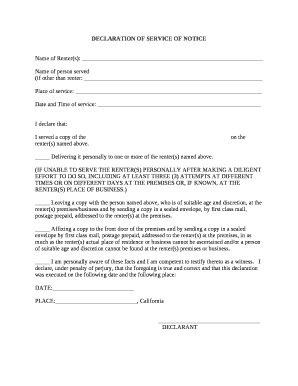

Legal Document Templates

Educational Templates

How to complete Saving Templates

Completing saving templates is a simple process that involves the following steps:

01

Choose the saving template that best fits your needs.

02

Customize the template by adding your information or making edits.

03

Save the completed document to your device or share it online.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Saving Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the purpose of saving?

Saving provides a financial “backstop” for life's uncertainties and increases feelings of security and peace of mind. Once an adequate emergency fund is established, savings can also provide the “seed money” for higher-yielding investments such as stocks, bonds, and mutual funds.

What does saving mean life?

: to stop someone from dying or being killed. If you donate blood, you might save a life.

What is the 20 50 30 savings rule?

The rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must-have or must-do. The remaining half should be split up between 20% savings and debt repayment and 30% to everything else that you might want.

What is saving and why do we save?

Simply put, saving is essentially setting aside money for future emergencies or purchases. From an economic point of view, saving is consuming less today so that you are able to consume more in the future.

How to save $10,000 in year?

If you need to save $10,000 a year, that means saving $833.33 a month. Breaking it down even further, this means you'll have to save $192.31 each week or $27.40 every day. If you're sharing this with a spouse – cut these numbers in two. You will need to save $13.70 a day.

What are the 3 types of savings?

While there are several different types of savings accounts, the three most common are the deposit account, the money market account, and the certificate of deposit.