Free Financial Planning Word Templates - Page 3

What are Financial Planning Templates?

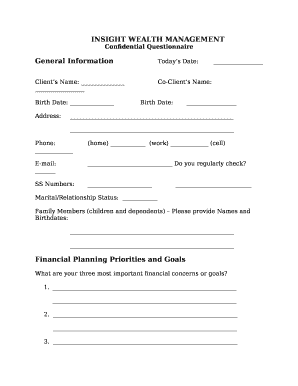

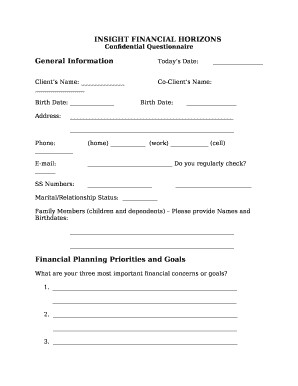

Financial planning templates are pre-designed documents that help individuals, businesses, and organizations manage their finances more effectively. These templates provide a structured framework for budgeting, forecasting, goal setting, and tracking financial progress.

What are the types of Financial Planning Templates?

There are several types of financial planning templates available, including:

Budget templates

Expense trackers

Income statements

Cash flow projections

Investment planning spreadsheets

How to complete Financial Planning Templates

Completing financial planning templates is easy with the right tools and mindset. Here are some steps to help you effectively utilize these templates:

01

Gather all necessary financial documents and information

02

Enter accurate data into the designated fields

03

Review the completed template for any errors or discrepancies

04

Make necessary adjustments based on your financial goals and priorities

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Financial Planning Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What are the 5 steps of financial planning process?

Financial Planning Process 1) Identify your Financial Situation. 2) Determine Financial Goals. 3) Identify Alternatives for Investment. 4) Evaluate Alternatives. 5) Put Together a Financial Plan and Implement. 6) Review, Re-evaluate and Monitor The Plan.

What are the 4 pillars of financial planning?

Four Pillars of Financial Planning Managing Cash Flow and Financial Resources. This critical first pillar focuses on making sure you and your loved ones are provided for. Accumulating Wealth. Managing Income Taxes. Planning for Retirement.

What are the 5 steps in financial planning?

5 Steps of the Financial Planning Process Step 1: Understand your current financial situation. Step 2: Write down your financial goals. Step 3: Look at the different investment options. Step 4: Create and implement a customized plan for you. Step 5: Re-evaluate and revise your plan.

What Is the Purpose of a Financial Plan?

Financial planning helps you determine your short and long-term financial goals and create a balanced plan to meet those goals.

What are the 7 components of financial planning?

A good financial plan contains seven key components: Budgeting and taxes. Managing liquidity, or ready access to cash. Financing large purchases. Managing your risk. Investing your money. Planning for retirement and the transfer of your wealth. Communication and record keeping.

What are the 5 key components of financial planning?

There are five essential components of a financial plan such as Insurance planning, Retirement Planning, Investment Planning, Tax Planning and Estate Planning.