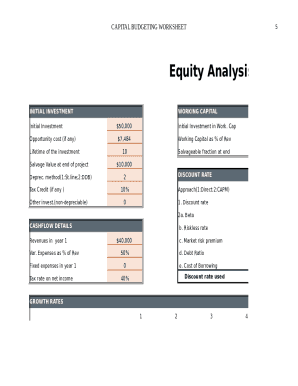

What is Equity Analysis Capital Budget?

Equity Analysis Capital Budget is a financial evaluation process that involves assessing the returns and risks associated with investments in a company's equity. It helps investors determine the potential profitability of investing in a particular company's stocks.

What are the types of Equity Analysis Capital Budget?

There are several types of Equity Analysis Capital Budget, including: 1. Fundamental Analysis 2. Technical Analysis 3. Quantitative Analysis 4. Qualitative Analysis 5. Market Timing Analysis

How to complete Equity Analysis Capital Budget

Completing Equity Analysis Capital Budget involves the following steps: 1. Gather relevant financial information 2. Analyze the company's financial statements 3. Use various analysis tools and techniques 4. Estimate future earnings and risks 5. Make an investment decision based on the analysis

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.